The concept of Capital Maintenance

According to the conceptual framework, the following are the two concepts of capital maintenance.

- Financial concept of Capital Maintenance

- Physical concept of Capital Maintenance

Financial Concept of Capital Maintenance

Under this concept, capital is equivalent to net assets or equity. According to the financial concept, capital is maintained if net assets or equity at the beginning is not higher than equity or net assets at the end. According to the concept, profit for the period is measured as the excess of the equity or net assets at the end over the equity or net assets at the beginning. In a period of inflation, financial concept of capital is based on money terms where the impact of inflation would not be taken into consideration, but under the constant purchasing power accounting method, financial concept of capital maintenance will be based on real terms where the impact of inflation or the purchasing power of money will be fully considered. It should be noted that under the constant purchasing power accounting, financial concept of capital maintenance will also consider the impact of general inflation and not specific inflation.

Physical Concept of Capital Maintenance

Under these concepts, capital is equivalent to the productive capacity or operating capacity of the reporting entity. According to these concepts, profit for the period is measured as the excess of productive or operating capacity at the end over the operating or production capacity at the beginning. Measuring capital based on physical concept, the impact of specific inflation must be taken into consideration while general inflation will be ignored .

Illustration

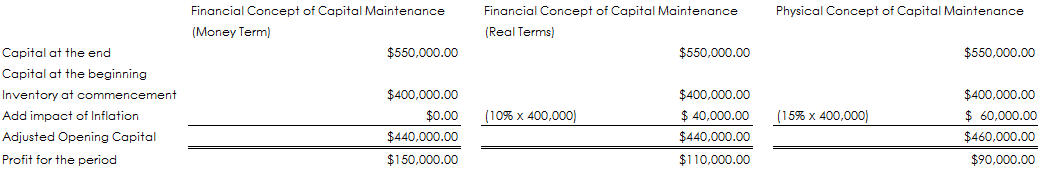

Greenhouse Plc commenced operations on 1st January 2007 with inventories amounting to US$400,000. During the period, the entire inventory was sold for cash for US$550,000. During the period ended 31st December 2007, Greenhouse Plc suffered a specific and general inflation rate at 15% and 10% respectively. You are required as the financial adviser to the board of Greenhouse Plc to recommend a maximum amount payable as dividend to the shareholders for the period ended 31st December 2007.

Calculation of Profit Earned for the period Ended 31st December 2007

Recommendation: According to the concept of capital maintenance, dividend payable in a period should not be more than the profit earned in the same period. The determination of profit value would be influenced by concept used in measuring capital from the computation above the profit earned for the period ended 31st December 2007 amounted to US$ 150, 000 based on money financial concept of capital while it is US$ 110,000 if based on real financial concept of capital. However, the profit for the period ended 31st December 2007 should be US$90, 0000 being the minimum possible profit for the year. However, if it is in the policy of ABC to measure capital based on financial concepts. The Maximum dividend payable will be US$110,000

Note: The best dividend policy to be recommended Is US$90,000. This is chosen with respect to the prudency concept of Accounting.

Treatment of Dividends & Additional Capital in Measurement of Capital Maintenance, dividend

- In deriving capital at the end, for the purpose of capital Maintenance measurement or profit measurements. Dividend paid during the period if any, should be added bank in deriving capital at the end

- For the purpose of capital maintenance or profit measurement. Additional capital introduced during the period should not be included in the calculation of capital at the end. This means that where capital at the end is given in a period where there was additional capital.

Recommended Readings

Frank Fabozzi., Financial management and analysis

Leave a Reply