What is Overhead?

Overhead has been defined as the total cost of indirect materials, indirect wages and other indirect expenses. The word “indirect “ in this context means that which cannot be allocated but which can be apportioned to or absorbed by cost centers or cost units.

Classifications of overheads

Overhead can be classified into 3, which are:

- By Function

- By Element

- By behavior

By function:

This can be further subdivided into:

- Factory overhead

- Admin overhead

- Selling and distribution expenses

By element

This can be further subdivided into:

- Indirect materials

- Indirect labor

- Indirect expenses

Behavioural Classification

This can be further subdivided into:

- Fixed expenses

- Variable expenses

- Semi fixed or semi variable expenses

Why do we account for overhead? We account for them in order to be able to ascertain the costs and profits incurred in products.

Allocation and Apportionment of Overhead

Cost allocation means the allotment of whole items of cost to cost centres or cost units, whereas cost apportionment means the allotment of proportions of items of cost to cost centres or cost units. Thus, when a whole item of cost can be attributed to a single department or cost centre, it is allocation. But when an item of cost is to be subdivided on a suitable basis to a member of cost centres, it is apportionment. However, that which cannot be allocated must be apportioned.

Basis of apportionment

Capital Value basis: The capital value of each building or each portion of the building occupied by each department is taken as the basis for apportionment expenses connected with the building, e.g depreciation, taxes and insurance on building. Similarly, the values of machinery in each department can be the basis with respect to depreciation and insurance on machinery.

Floor area occupied or cubic capacity basis: Expenses like rent, lighting, heating, air conditioning, fire precaution measures and building maintenance can be apportioned on the basis of floor area occupied by various departments. If there is a difference in respect of height, the cubic capacity basis is preferred.

No of employees or departmental wages: This basis is suitable for canteen expenses, club recreation expenses, time keeping, hospital and general welfare expenses, compensation and other fringe benefits, contribution to provident funds etc.

Technical estimates: Wherever possible, expenses are apportioned on a careful technical assessment. Examples are lighting charges which is based on light bulbs, watts used, electric power etc.

Production hour basis: Majority of general overhead items are apportioned on the basis of departmental labour hours or mechanical hours, e.g factory management and supervision expenses, research and development cost, consumable stocks etc can be apportioned on this basis.

Let’s take an example:

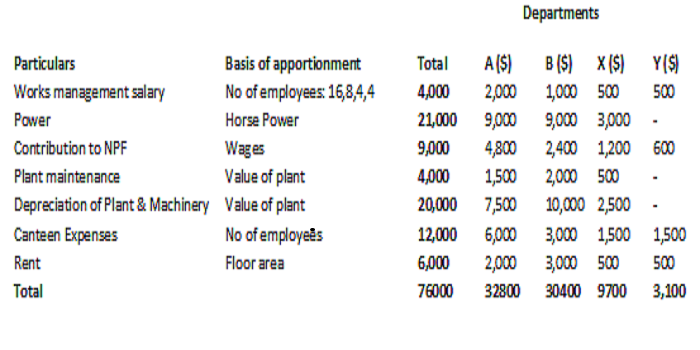

X company limited is divided into two production cost centres A and B and two service centres X and Y. The following is the summary of overhead costs for a particular period.

| Particulars | Amount | ||

| Works management Salary | 4000 | ||

| Power | 21000 | ||

| Contribution to NPF | 9000 | ||

| Plant Maintenance | 4000 | ||

| Depreciation of Plant and Machinery | 20000 | ||

| Canteen Expenses | 12000 | ||

| Rent | 6000 | ||

The following is mad available from the various departments

| A | B | X | Y | |

| No of employees | 16 | 8 | 4 | 4 |

| Area occupied (in sq.ft) | 2,000 | 3,000 | 500 | 500 |

| Value of plant | 7,500 | 100,000 | 25,000 | – |

| Wages | 40,000 | 20,000 | 10,000 | 5,000 |

| Horse Power | 3 | 3 | 1 | – |

Apportion the cost to various departments on a more suitable basis.

Possible solution:

X Company Ltd

Departmental Overhead Distribution Summary

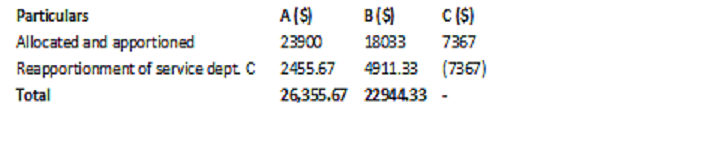

Re-apportionment of service department costs to production departments

This is the next step in our attempt to ultimately apportion overhead cost to production unit. Some authors regard this process as secondary distribution process.

Basis of re-apportionment

The service department costs are apportioned to production departments on the basis of services rendered by the production department.

Table of basis of re-apportionment

| Service dept. | Basis | |

| Maintenance dept. | Direct Labor hour | |

| Time keeping dept. | Direct Labor hour or machine hour | |

| Project & Planning dept. | Direct labor hour | |

| Payroll dept. | Direct Labor hour | |

| Canteen or recreation | No of employees | |

| Personnel dept. | No of employees | |

| Labor welfare dept. | No of employees | |

| Internal transport dept. | weight or value of material carried | |

| Purchase dept. | no of purchase orders or value of materials consumed by each dept. | |

| Store dept. | No of requisitions or value of material used | |

| Building dept or building service | Floor area | |

| Fire protection service | capital value of assets | |

| Power house and other services | Horse power or wattage |

Methods of reapportionment

Today, we would be treating examples of the two most common methods of re-apportionment, which are:

- Direct redistribution

- Step Method

Other methods include:

- Reciprocal method

- Repeated distribution method

Direct Distribution method: Under this method, services rendered by one service department to other service departments and vice versa are totally neglected. The service department costs are entirely distributed to only the products department.

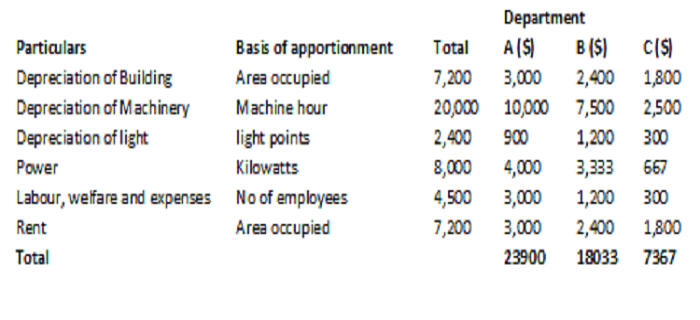

Example: The particulars of on-cost incurred by a manufacturing concern commonly for production departments A and B and service department C are as follows.

|

Items |

On-cost |

| Power | 8,000 |

| Labor, welfare expenses | 4,500 |

| Rent | 7,200 |

| Depreciation | |

| Machinery | 20,000 |

| Building | 7,200 |

| Lighting | 2,400 |

You are further supplied with the following information:

| Departments | |||

| Particulars | A | B | C |

| Kilowatt | 12 | 10 | 2 |

| Light Points | 15 | 20 | 5 |

| Area Occupied (in sq metres) | 1000 | 800 | 600 |

| No of employees | 20 | 8 | 2 |

| Machine hour | 2000 | 1500 | 500 |

Note: The expenses of the service department C is shared between Production department A and B in the ratio of 1:2

Possible solution

Primary distribution summary (apportionment to the three departments)

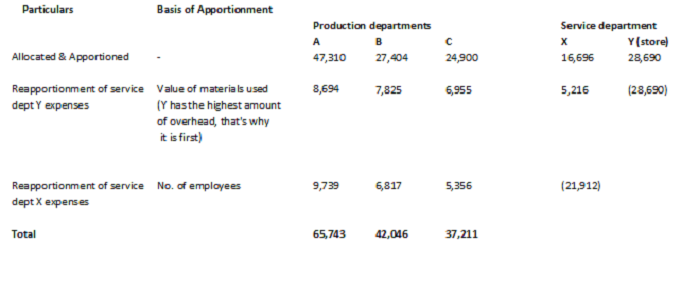

Step distribution Method

This method of reapportionment deals with a sequence of reapportioning service costs among the various departments. First we reapportion the service department with the larger/ largest amount of overhead, or the service than renders a larger amount of its services to other service departments. We do it sequentially, taking the highest first and progressing to the service department with the lowest amount of overhead or lowest percentage of its total services to other service departments

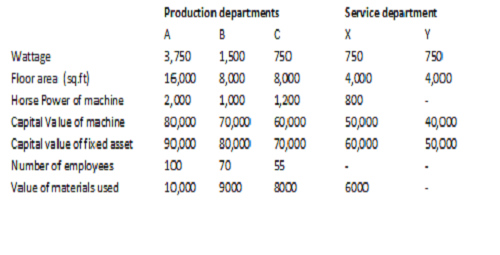

Let’s take an example

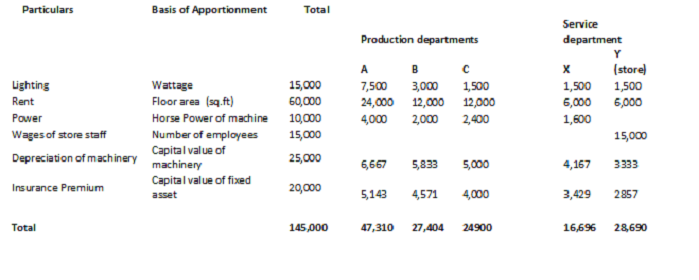

Enigma ltd has three production departments (A,B,C) and two service departments (X,Y). The estimated figures for a certain period are as follows:

| $ | |

| Lighting | 15000 |

| Rent | 60000 |

| Power | 10000 |

| Wages of store staff | 15000 |

| Depreciation of machinery | 25000 |

| Insurance Premium | 20000 |

Possible solution

Recommended Readings

Colin Drury., Management Accounting for Business

Jae sim., Joel siegel., Schaum’s outline of managerial accounting

Leave a Reply