Investing in the Stock Market, and how to benefit by trading in it.

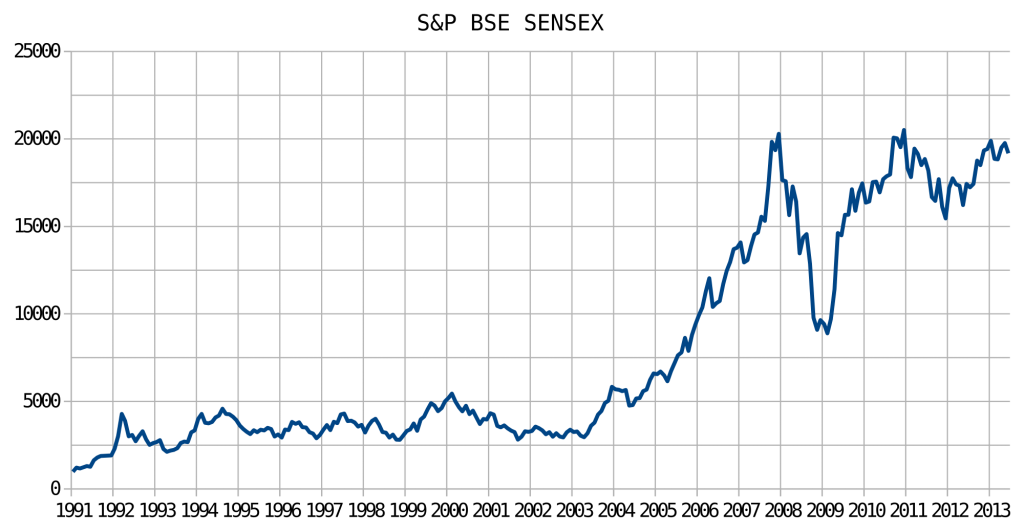

Thirteen (13) years ago, the Nigerian stock market was on a journey to becoming bullish. People were trading stocks, and the Nigerian populace became more aware of the stock market; this was in the year 2003. It all began as a result of the economic reforms that began in 2003, earning Nigeria a BB-credit rating which led to US$18bn debt write-off and created pension funds which have several billions of Naira to be invested in Nigerian securities, investors’ confidence was ignited and lifted in Nigeria Stock Market. The banking sector was also a catalyst to the bullish run of the Nigerian stock market.

The CBN mandated recapitalization of the banking sector, and this fueled a boom in the equity market. Most Nigerian bank’s stock increased in value many folds, despite billions of Naira of new shares being issued, with some stocks more than quadrupling in value in less than a year between 2004 and 2007. Companies kept the free float of offers which were greatly matched by demand, and the capital market thus became the haven for profit taking. Unfortunately for me, I was about 9 years old when the bullish run started, and I knew little about trading stocks.

Luckily for me, my mum invested in some big name companies for myself and my sister during that period. Even though my mum was a non-finance person, she knew the importance of trading stocks and profiting from it. All was going smoothly for Nigeria in the stock market between the year 2003 to 2008. Fast forward 6 years later from 2003 (2009), everything changed. From an all-time high of N13.5 trillion market capitalization in March 2008 the stock prices experienced a free-for-all downward movement to generate less than N4.6 trillion market capitalization by the second week of January 2009 and N6.53 trillion as at last trading day of 2011. During this period, supply of stocks was way higher than the demand for them. More than 60% of slightly above 300 quoted securities were on constant offer on a continuous basis. Stocks became very illiquid as no one wanted to venture into the business of buying stocks. Stock holders were trapped. They wanted out, but no one was willing to bail them. Fresh investors became cautious of jumping into a vehicle that does not seem to have a brake should they wish to disembark. With exploratory research, the study discovered that the downturn was caused mainly by fears of contagion effects of the then rampaging global financial crisis.

The consequences to the Nigerian populace was cataclysmic. Investors lost billions, investor confidence was deflated, and the capacity of pension funds to meet their obligations as they become due became doubtful. The Nigerian stock market never fully recovered from the meltdown in 2009, but some investors still profited today. These investors are those who took the risk of going ahead to invest in Nigerian stocks when they became penny stocks in 2009. This strategy is known as the contrarian Investment strategy. A contrarian is a person who takes up a contrary position, especially a position that is opposed to that of the majority. In the case of the Nigerian stock market, a contrarian investor is one who would have invested heavily in the stock market after stock prices fell to rock bottom. As soon as the stocks pick up, they sell it off, thereby making profit from the stock earlier purchased. And so it happened, stocks picked up a little after they fell to penny stocks in 2009; a contrarian investor would have profited heavily on this.

Some people shy away totally from investing in stocks or trading stocks because of the risk of losing their investments. It doesn’t have to be so, you can profit greatly from trading stocks so far you carry out thorough research on the stocks you want to invest in, put your ears to the ground for news (financial, economic or political news) that may affect the stock, and you should also have a trading strategy.

This post is being published for the purpose of discussing some trading strategies that may work for you. Now let’s begin. To get a good understanding, we start with what stocks are, and then progress to some stock trading strategies.

What are stocks?

Stocks are financial instruments representing a share in the ownership of a company. A stock holder has a claim on a company’s assets and earnings. Earnings may be distributed quarterly, semi-annually or annually in the form of dividends. Owning a stock of a company doesn’t mean you would participate in the day to day running of the business. The business is vested in the hands of professional managers whose main duty or objective is to ensure shareholder’s wealth maximization. There may be conflict of interest by the managers (this is when they seek to increase their own individual wealth and fatten their pockets at the expense of the shareholders), but nowadays, to curb this problem, Companies give out stock options to their employees either as bonus or part of their remuneration. This is to align the objectives of managers with the objectives of the company. Managers being shareholders now, would seek to maximize their wealth as shareholders, as well as the wealth of other shareholders. If the management fails at adding value and maximizing shareholder wealth, then the shareholders have the power to vote in order to have the management removed and replaced.

When you buy a stock, you are meant to receive a stock certificate, representing proof of your ownership in the company. Nowadays, you rarely do receive physical stock certificates. What is more common as of now is receiving a digital format of the certificate on your online brokerage account; this is because shares are widely traded electronically, through the use of an online brokerage.

Example of a stock certificate

Stock requires a stock market for trading activities. A stock market can be also known as an equity market. It is where buyers and sellers of shares of publicly traded companies meet to trade. It doesn’t have to be physical since many of stock trades now happen electronically. Stock prices are used to determine the current price at which stocks would be traded. They usually fluctuate; meaning that they can rise or fall at any given time. Stock prices are driven by factors such as demand and supply for the stock, the expectation of corporate earnings, company’s perceived value, macroeconomic, and geopolitical factors.

The law of demand and supply also comes into play as regards the stock market. If demand for a stock exceeds the supply for the stock, then the price of the stock would rise. On the other hand, if there is an oversupply of the stock, the price of the stock might fall. A company’s perceived value is the worth investors have of the company and its future prospects. This affects the price the investors are willing to pay for the stock.

Corporate earnings drive stock prices in this way: if a company performs well, and corporate earnings are high or investors anticipate high profits, then investors increase their demand for the stock of that company; thereby pushing stock prices up. On the other hand, if a company does poorly and corporate earnings are low, the company loses value and investors would be in a rush to sell off the stock. This pushes the stock price down.

As regards the macro economic factors, let’s take an example of the effect of employment news on stock prices. If there is positive news of employment, then there is an expectation that corporate earnings would rise. As earlier discussed, an anticipated rise in corporate earnings would fuel renewed demand for the stock, thereby pushing the price upwards. An increase in employment brings about an expected increase in corporate earnings because an increase in employment brings about an increase in spending’s by the workers who slip into the role of consumers. For Geopolitical factors, if a country faces crisis in transfer of power, or war emanates, then the stock market in that country would be negatively affected; take for example the crisis in Syria.

There are stock indices that measure the value of a section of the stock market. They can be used to monitor the stock market for the selected companies listed in the index, and they can also be used to compare results on specific investments. Examples of Stock Indices include the Dow Jones Industrial average and the Standard & Poor (S&P 500). The Dow Jones industrial Average measures the daily price movements of 30 of the largest companies in America. Dow Jones industrial is calculated by using the price weighted average. S&P 500 is another popular stock index; it is a collection of 500 stocks chosen for their market size, liquidity and industry grouping. S&P represents about 70% of the total value of US stock markets. It is widely regarded as the best single gauge of large-cap U.S. equities. Other common indices are the DAX 30 (Deutscher Aktien index), NIKKEI 225, FTSE 100, NASDAQ Composite index, Mexico IPC Index, SWISS market index, OMX STOCKHOLM index, and HANG SENG Index to mention a few.

Major Participants in the stock market:

Let’s take a look at the big boys in the stock market:

- Investment Banks: The major role they play in the stock market is the provision of advisory services and underwriting services for companies that want to float on the stock market. Other roles provided by investment banks in the investment management world include banking for institutions, companies and government, corporate finance, wealth management for high net worth or institutional investors, and securities trading.

- Brokerage: An Investment bank is aimed at institutional investors, while a brokerage is mainly for individual investors. Brokerage firms serve a clientele of investors who trade public stocks and other securities. They handle buy or sell orders of securities for investors. They get a commission in return for their service.

- Pension funds: Pension funds also play a very important role in the stock market. The main purpose of a pension fund is to invest the accumulated contributions of various employees in order to provide an income on retirement. With a lot of money at their disposal, Pension funds venture into the stock market to invest. When they invest, they invest huge amounts as institutional investors. So depending on the intensity of their investments, they might have a say on how the company is run and in the company’s policies as opposed individual investors.

- Mutual funds: Like pension funds, mutual fund is a pool of funds. Mutual funds invest in various types of securities. For their investment in the stock market, they might track an index and try to outperform the tracked index. Mutual funds take a percentage of the Total Assets under Management (AUM) as fees for the services rendered. They might also take performance incentives based on their performance. You can read more on mutual funds here: Mutual Funds

- Hedge Funds: Hedge funds share similar characteristics with mutual funds and pension funds, which is that it is a pool of funds. But unlike mutual funds and pension funds that are primarily traditional investments, hedge fund goes beyond traditional investments. Their investment strategies, compensation and regulatory structure differ from that of a mutual fund or pension fund. They are more aggressive in their investment strategies, and they may sometimes fund investments with leverage. you can read more on hedge funds here: Introduction to hedge funds

- Prop Trading firm: Trading of instruments such as stocks, bonds, currencies, commodities and other financial instruments by a trading firm on its own behalf in order to make a profit on its trade.

- Retail investors & Day traders: These are individual investors like you and I who seek to profit from trading a few number of stocks.

INVESTING IN THE STOCK MARKET

In the stock market, you either invest in primary or secondary stocks. Stocks from the primary market are gotten from IPO’S (Initial public offerings). A primary market is a market where company’s or other financial institutions sell securities such as stocks and bonds for the first time. An IPO occurs when a private company is in the process of going public; so it issues its share out to the public for the first time. A secondary market on the other hand is a market for investors. This is where investors trade among themselves. Securities traded are securities previously issued, but without the involvement of the issuing company.

Why trade in stocks?

These are some few reasons why we should trade in stocks:

- Capital gains: If you pick out penny stocks and they grow really well, maybe like 10x more than what you invest in, that is a great gain. You would be getting a 1000% ROI.

- Income: Dividends stock brings to the investor can be a source of income for the investor. The Investor shares in the profit made through dividends, meanwhile if the stock market is stable he doesn’t have to lose any part of his investment. It is like he is getting paid to finance a company, with his finance still intact.

- Higher returns than some other assets: There is no limit to what you can gain with stocks. If you are able to make the right stock pick, like say the next Microsoft or Apple, then you can cash in on returns you wouldn’t dream of in a million years with other assets classes.

- Diversification: Investment in Stocks serves as a source of diversification for investors. They can invest in stocks as well as other assets like bonds, commodities in order to reduce their exposure to risk.

I am sure with this, you would be wandering how you can partake and join the stock investment train. Well it is easy. The first step would be to open a brokerage account. As mentioned earlier, a brokerage account avails individual investors like you and I the opportunity to trade in the stock market. It is very important you choose one that is right for you. The best would be a broker that trades in the markets you want, a broker that can enable you carry out quick stress-free transactions, and also one with low brokerage fees. The fact is that you need to carry out thorough research when choosing a broker.

When you are settled with an online brokerage of your choice, then you can begin trading with them. In your console, you would see an offer price and a bid price. A bid price is the price the broker is willing to pay you for stock (assuming you are selling), while the offer price is the price the broker is willing to sell it’s stock to you (assuming you are looking to buy). There is usually a difference between the bid price and the offer price by brokers, with the offer price usually higher than the bid price. The difference between these two prices (Spread) is the broker’s profit.

Types of orders you can place with your broker:

- Market Orders: This is an order to be executed immediately at current market prices. The risk inherent in a market order is that the buyer or seller is unaware of the price of the trade until after the trade. So a market order is used when certainty of execution is a priority over the price of execution.

- Limit orders: A limit order is an order to buy or sell a stock with a brokerage at a specific price or better. If the limit is not reached, the stock cannot be bought or sold. Limit orders are always placed away from the market because most times, the investor who places such an order either seeks to buy below the market price or sell above the market price.

- Stop loss order: The main purpose of a stop loss order is to limit an investor’s loss on a position in a security. It is an order that is placed by an investor, instructing his broker to automatically sell if a stock drops to a certain price.

STOCK CHARTS

Stock charts are very important tools to use when trading. They contain an immense amount of data, and can be used to predict where the stock is heading

Example of a stock chart:

Stock Chart Technical Analysis

It is believed that by studying the patterns of a stock chart, you might be able to predict the movement of the stock in the later years. There are two patterns in the area of technical analysis. They are the reversal and continuation pattern. The reversal pattern gives a signal to the investor that a prior trend would reverse upon completion of a pattern, while a continuation pattern signals that a trend would continue once a pattern is complete.

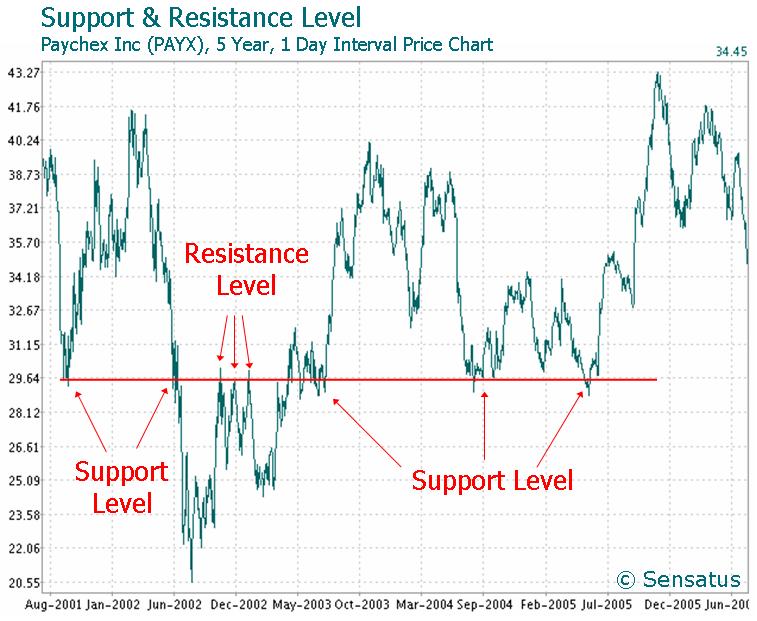

Chart Analysis Tool

Support and resistance tool: Support and resistance is used to identify trends on a stock chart. It can be used to determine entry and exit point of a particular stock. The support level refers to a price on the chart that acts as a floor for a period, the price of the asset does not fall below this price within this period. A resistance level is the level at which the price of the asset fails to rise above within the specified period. Let me explain it this way, with the graph below, we can see that within the period of December 2002 to May 2003, the stock of Paychex Inc fails to rise above $29.64. So we call the price level near $29.64 the level of resistance. For that period, $29.64 acted as the ceiling because this price level prevents the market from moving upwards.

During the period of August 2003 to July 2005, the price of Paychex Inc stocks maintain a cushion of $29.64, and does not at any point in time fall below it. The price of $29.64 represents a good buying opportunity for Investors within this period because this is generally the area where market participants see good value and start to push prices higher again.

MACD (Moving Average Convergence Divergence): The MACD is also a stock chart analysis tool. The MACD was created by APEL in the year 1970. Its main purpose is to reveal changes in the strength, direction, momentum, and duration of a trend in a stock price. MACD is a trend following momentum indicator. It turns two trend following indicators, moving averages into a momentum oscillator. This momentum oscillator is derived by subtracting the longer moving average from the shorter moving average. For example subtracting the 26 day exponential moving average from the 12day exponential moving average.

Example of historical stock price data (top half) with the typical presentation of a MACD (12,26,9) indicator (bottom half). The blue line is the MACD series proper, the difference between the 12-day and 26-day EMAs of the price. The red line is the average or signal series, a 9-day EMA of the MACD series. The bar graph shows the divergence series, the difference of those two lines.

This chart can help traders make buy and sell decisions in the following ways: When the MACD falls below the signal line; this might be an indication that it is time to sell because it is a bearish signal. When the MACD rises above the signal line, it might be an indication of time to buy more of the stock as the price is expected to rise; it is a bullish signal.

Trading Strategies

- Day Trading: As the name implies, it is a trading strategy for buying of stocks which are expected to be sold within the same day. It is an event driven trading strategy. Traders target volatile stocks and trade on the back of recent news or earnings report of a company or macro-economic news affecting the industry or the firm.

- Swing trading: This is trading that targets the end of a trend in a stock by using technical analysis, and then jumps on board when a new trend is about to begin. The reason is that it is believed that there is usually price volatility has the new trend tries to establish itself. Swing trading is short term, but unlike day trading, it lasts more than a day.

- Pair Trading: Pair trading is a market neutral strategy that enables traders profit from any given market condition. The strategy is also known as a statistical arbitrage strategy, and convergence trading strategy. A pair trading strategy matches a long position with a short position in a pair of highly correlated instruments. The pair traders wait for a dip in the correlation of the instruments. He then goes long on the under performing instrument, and short on the performing instrument. He profits from a difference in price change between the two instruments.

- Stock Picking: This is a long term trading strategy, investors such as Warren buffet became billionaires through this strategy. The key is to perform a thorough fundamental analysis by analyzing stocks in an industry you are very familiar with. First understand the business, look at the intrinsic worth of the company, assess the ability of the company to have consistent earnings, good return on equity and capable management. Pick the stock of a company you believe in, a company you would be comfortable holding its stock for a long time.

I hope this write up would help you overcome any fear you might have against investing in the stock market. Investing in stocks can be highly profitable, but remember you need to carry out thorough research if you plan on investing in the stock market as people are liable to lose part or all of their investments in the stock market.

Recommended Readings

Tycho Press.,Stock Market Investing for Beginners: Essentials to start investing successfully

Benjamin Graham., Jason Zweig., and Warren Buffet., The Intelligent Investor: The Definitive Book on Value Investing.

Jason Kelly., The Neatest Little Guide to Stock Market Investing: Fifth Edition

Awesome efforts, keep continue the Great work. The content you described is really beautiful. Hope you will write some more valuable posts.

Epic Research

Dear Chetan, thank you for your remark on my post. Words like this encourage me to do more, and hopefully, i will continue to publish more valuable posts for my esteemed readers.