International trade

International trade extends the principle of the division of labor and specialization to countries. It originated on the basis of nations exchanging their products for others which they could not produce for themselves. International trade arises for a number of reasons which include:

- Different goods require different proportion of factors and inputs in their production.

- Economic resources are unevenly distributed throughout the world.

- The international mobility of resources is extremely limited since it is difficult to move resources between nations, the goods which “embody” the resources must move.

The main reason for trade is that there are differences in the relative efficiency with which different countries can produce different goods and services.

International banks

These banks assist multinational enterprises in the following ways, with some specializing in particular areas:

- The financing of international trade

- The financing of capital projects

- International cash management services

- Providing full local banking services in different countries

- Lending in foreign exchange and currency options

- Participating in syndicated loan facilities

- Underwriting of Eurobonds

- Provision of advice and information

Developments in international financial markets

Among the more important developments affecting international financial markets in recent years are:

- Globalization

- Securitization of debt

- Risk management (and risk assessment)

- Competition

Globalization: Globalization describes the process by which the capital market of each country has become internally integrated. Securities issued in one country can now be traded in capital markets around the world. One way this can happen is by the purchasing of depository receipts by foreign investors. A depository receipt s a negotiable instrument that represents the publicly traded securities of a foreign company. They are usually issued by a bank in the local country, and they can be sponsored depository receipts or unsponsored depository receipts. To learn more about depository receipts, please visit : Public equity vs Private equity

Securitization of debt:

This refers to international borrowing by large companies, not from a bank but by issuing securities instead. This has been possible because of the deregulation of capital markets. Securitization of debt is popular with borrowers because this form of borrowing is cheaper. There are no intermediary fees and it is more flexible than bank loans. Examples of securitized debts are Eurobond and euro commercial paper.

Risk management (and risk assessment)

Various techniques have been developed for companies to manage their financial risk. The existence of such transactions, which are harder to monitor where they are off balance sheet, make it difficult for banks and other would be lenders to assess the financial risk of a company that is asking to borrow more money.

Competition

There is much fiercer competition between financial institutions for business. Building societies are emerging as potential competitors to the banks.

International capital markets

Larger companies may arrange borrowing facilities from their bank, in the form of bank loans or bank overdrafts. They might as well prefer to borrow from private investors. In other words, instead of borrowing say $10,000,000 bank loan, a company might issue “bonds” or “paper” in order to borrow directly from investors with:

- The bank merely acting as a go-between finding investors who will take up the bonds or paper that the borrowing company issues

- Interest being payable to investors themselves, not to a bank.

In recent years, a strong international market has built up which allows very large companies to borrow in this way, long term or short term.

Syndicated credits

A “credit” in this context is a facility whereby a borrower can borrow funds when required, but might in fact not take up the full amount of the facility. This differs from a loan, which involves an actual transaction for a specified sum for a particular period of time. The syndicated credit market provides credit facilities at relatively high rates of interest, typically at a substantial margin above LIBOR. The market is frequently used by highly geared companies.

- Such a company might need such a facility if it is involved in a takeover bid, in which case it will use the standby credit to fund the acquisition of the bid if successful.

- The market is also used in the re-financing of debts incurred in past takeovers in cases where the company has been unable to obtain alternative funds to pay off the debt.

Methods of reducing the risks of bad debt in foreign trade

Some methods that may be used to reduce the risk of bad debt in foreign trade include:

- Export factoring: Export factoring is essentially the same as factoring domestic trade debts. The main aspects of factoring are:

- Administration of the client’s invoicing, sales accounting and debt collection services.

- Credit protection for the client’s debts, whereby the factor takes over the risk of the loss from bad debt and so insures the client against such losses. This service is also referred to as debt underwriting or the purchase of a client’s debt. The factor usually purchases these debts without recourse to the client which means that if the client’s debtor does not pay what they owe, the factor would not ask for his money back from the client.

- Making payments in advance of collecting the debts. This is sometimes referred to as factor finance because the factor is providing the cash to the client against outstanding debts.

A factoring service typically offers prepayment of up to 50% against approved invoices. Service charges vary between around 0.75% and 3% total Invoice value, plus finance charges at levels comparable to bank overdraft rates for those taking advantage of prepayment arrangements.

The benefits of factoring for a business customer

Some of the benefits include:

- The business can pay its suppliers promptly and so be able to take advantage of any early payment discounts that are available.

- The optimum stock levels can be maintained, because the business will have enough cash to pay for the stocks it needs.

- Growth can be financed through sales rather than by injecting fresh capital.

- The business gets finance linked to its volume of sales. In contrast, overdraft limits tend to be determined by historical balance sheets.

- The managers of the business do not have to spend their time on the problems of slow paying debtors.

- The business does incur costs of running its own sales ledger department.

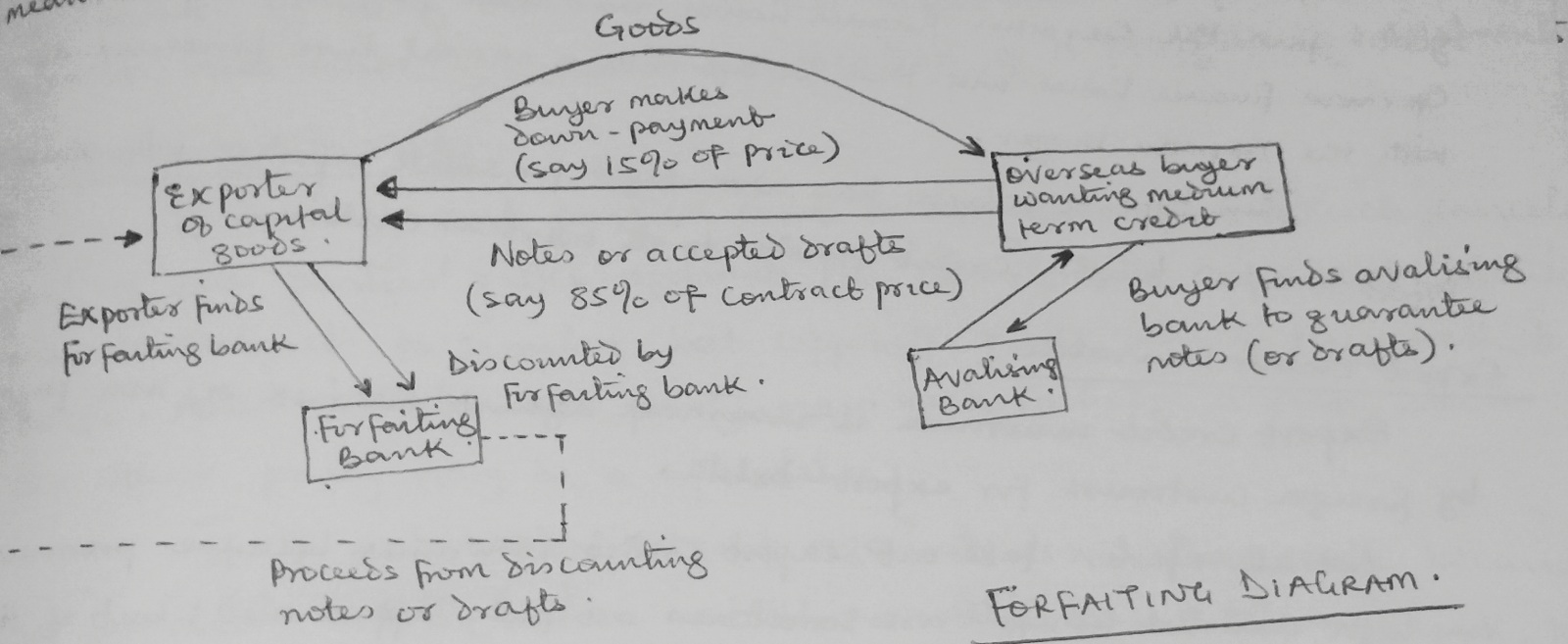

Forfaiting

Forfaiting works as follows:

- An exporter of capital goods finds an overseas buyer who wants medium term credit to finance the purchase. The buyer must be willing to:

- Pay some of the cost (perhaps 15%) at once

- Pay the balance in regular installments (perhaps every six months) normally for the next 5 years.

- The buyer would either

- Issue a series of promissory notes

- Accept a series of drafts with a final maturity date about 5 years ahead but providing for regular payments over this time.

- If the buyer has a very good credit standing, the exporter might not ask for the promissory notes (or drafts) to be guaranteed. In most cases however, the buyer would be required to fund a bank which is willing to guarantee (avalise) the notes or draft.

- At the same time, the exporter must find a bank that is willing to be a “forfeiter”. Some banks specialize in this type of finance

- Forfaiting is the business of discounting (negotiating) medium-term promissory drafts or bills. Discounting is normally at a fixed rate notified by the bank (forfeiter) to the exporter when the financing arrangement is made. If the exporter arranges forfaiting with a bank before the export contract is signed with the buyer, the exporter will be able to incorporate the cost of discounting into the contract price.

- The exporter will deliver the goods and receive the avalued promissory notes or accepted bills. He will then sell them to the forfeiter, who will purchase them without recourses to the exporter. The forfeiter must now bear the risk; that is,

- The risk of non-payment

- Political risks in the buyout country

- The transfer risk that the buyer’s country might be unable to meet its foreign exchange obligations.

- The foreign exchange risk; the forfeiter holds the promissory notes and has paid cah to the exporter, and therefore it is the forfeiter who accepts the exchange risk.

Forfaiting is a method of providing medium term export finance, which originated in Switzerland and Germany where it is still very common. It is used for export sales involving capital goods (machinery etc), where payments will be made over a number of years. Recently, forfaiting has come to be used increasingly as a short term financing tool. Forfaiting can be an expensive choice, and arranging trade to occur in cases where other methods of ensuring payment and smooth cash flows are not certain, and in most cases where trade may not be possible by other means.

Forfaiting diagram

Note: Factoring as compared with forfaiting is widely regarded as an appropriate mechanism for trade finance and collection of receivables for small to medium sized exporters, especially were there is a flow of small scale contracts.

International credit union

International credit unions are organizations or associations of finance houses of banks in different countries. The finance houses or banks have reciprocal agreement for providing installment credit finance. When a buyer in one country wants to pay for imported goods by installments, the exporter can approach a member of the credit union in his own country which will thus arrange for the finance to be provided through a credit union member in the importer’s country. The exporter receives immediate payment without recourse to him. The buyer obtains installment credit finance. Without the existence of international cooperation between members of a credit union, importers would have more difficulty in obtaining credit finance.

Suppose for example that an exporter in Nigeria wishes to sell some capital goods to a customer in Germany and the customer wants to pay for the goods by installment. The exporter can approach a member of an international credit union in Nigeria and ask for the necessary installment finance to be arranged through German members of the credit union. Details of the proposed sale will then be given to the German member (ie German finance house or bank) which will then decide on the terms of installment credit it [will offer to the German buyer (In accordance with the German laws and practice).

The Nigerian finance house will receive full payment for the goods from the German finance house and then pay the exporter. The German finance house will then be left with a normal hire purchase agreement with the German buyer.

This type of scheme has advantages for small exporters who cannot afford lengthy credit periods to its overseas customers.

Export credit insurance

Export credit insurance is insurance against the risk of non-payment of foreign customers for export debts. Not all exporters take out export credit insurance because premiums are very high and the benefits are sometimes not fully appreciated; but if they do, they will obtain an insurance policy from a private insurance company that deals in export credit insurance.

You might be wondering why export credit insurance should be necessary, when exporters can pursue non-paying customers through courts in order to obtain payment. The answer is that:

- If a credit customer defaults on payment, the task of pursuing the case through a court will be lengthy, and it might be a long time before payment is eventually obtained.

- There are various reasons why non-payment might happen. Export credit insurance provides insurance against non-payment for a variety of risks in addition to the buyer’s failure to pay on time. Export credit insurance is not essential, especially when exporters are reasonably confident that all their customers are trustworthy.

Recommended Readings

Timothy Taylor., The instant economics: Everything you need to know about how the economy works.

Leave a Reply