The Income Statement

The income statement has many names; it may be called the statement of earnings, statement of operations or the profit and loss statement. The income statement is of utmost importance to the equity research analyst because from the statement he is able to analyze, predict future earnings and make recommendations. The Income statement is one of the required statements a company must file at the end of an accounting period, alongside two other statements which are the statement of financial position and the Statement of cashflows.

The income statement starts from the top line which is the revenue and work its way down to the bottom line which is the net income. We take the net revenue and subtracting expenses (including interests and tax) to arrive at net income. Under the international financial reporting standard, the income statement can be combined with other comprehensive income and presented as a single statement of comprehensive income

The income statement is crucial for people with interests in a company. For example current investors or potential investors examine a firm’s income statement for valuation purposes while lenders examine the income statement for information about the firm’s ability to make the promised interest payments and also the principal payments on its debt.

Breaking down the key component of an income statement

- Revenue: Revenue is the total amount received from the sale of goods and services in the normal course of business. Revenue less adjustments for estimated returns and allowance is known as net revenue. Revenue includes net sales, interest income and increase in owner’s equity.

- Expenses: Expenses are cash outflows in a business. They are the amounts incurred to generate revenue. Expenses may include the cost of goods sold, interest, taxes and operating expenses (operating expenses such as: sales and marketing, compensation and non-facility fees , insurance costs , utilities, repair and non-production facilities

Expenses can be grouped by nature, and function. Expenses grouped by nature disclose expenses according to their nature. For example presenting all wages and salaries irrespective of the department it emanates from. Another example of grouping expenses by nature is presenting all depreciation expenses from manufacturing and administration together in the income statement. Grouping expenses by function on the other hand is when expenses are grouped based on how they help create revenue. For example, cost on raw materials, labour, and overhead are costs incurred in the manufacturing process and can be grouped under manufacturing costs.

- Gain or loss from the sale of assets: In the income statement, gains or losses resulting from the sale of an asset is also included. Gains may or may not result from ordinary business activities, and they may be seen as additional income. Gains are added to revenue, while losses are considered an expense and subtracted from revenues.

- Cost of goods sold: They are direct costs attributable to the production of goods sold by a company. They can be traced in an economically feasible manner to the production of a good for sale. It includes the cost of raw materials used, and the cost of direct labor.

- Gross profit: This is the profit derived when all direct costs have been removed. It can be derived by taking the net revenue and subtracting from it the cost of goods sold.

- Operating profit: Operating profit is gotten when we subtract operating expenses from gross profit. Operating expenses are the costs incurred in running a business. They are non-production costs, but essential in carrying out the organization’s day to day activities, and also making sales. Examples of operating expenses are depreciation, sales commissions, advertising costs, rent cost for non production facilities, property taxes, legal fees, insurance costs and accounting expenditures. Operating profit is profit before financing cost and income taxes. It can also be called profit before interest and taxes (PBIT) or Earnings before interest and taxes (EBIT).

- Income before tax: To derive this, we take the operating profit and subtract interests from it. The income before tax excludes tax when subtracting all the expenses. The income before tax shows us how much the company has earned after the cost of goods sold, interest, selling general and admin expenses.

- Net income: Net income is also referred to as net profit of PAT (Profit after tax). It is called the bottom line of the business. In deriving the net profit, all expenses would be subtracted; These expenses include cost of goods sold, expenses, interests, and taxes. Net income is known as profit attributable to shareholders; part of it might be distributed out to shareholders as dividends, while the remaining may be retained and transferred to a reserve.

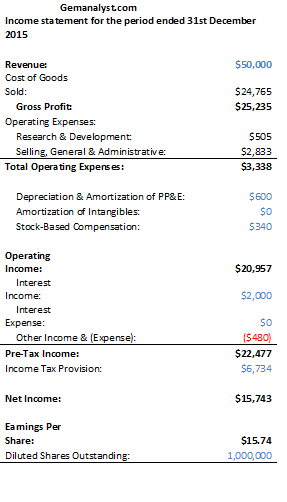

Example of an Income statement

Concept of accruals

The accrual concept in accounting means that revenues and expenses are recorded in the period they occur, regardless of the timing of cash flows. Accruals help to ascertain the degree of economic activity within a given period. Without accruals, revenues and expenses may be recognized on cash basis, and revenue earned in previous years or expenses incurred in previous periods would be recognized in the present year because of cash received or cash paid; this does not give the real picture of the activities of a business within a given period of time.

Let us now look at the treatment of types of accruals

- Unearned Income: Unearned income is income that has already been paid for by your client, but you have not yet supplied the goods or rendered the services required to earn it. Unearned income is a liability to the company; the liability is reduced as the revenue is earned. A good example is a magazine publisher. He receives subscription payments for 12 months (January to December) by January. The income he received is classified as unearned income because he has not yet supplied the magazines. There is an increase in cash (an asset) and also a corresponding increase in unearned income (liability). As the magazines are delivered monthly, the publisher recognizes revenue on the income statement and the liability is reduced.

- Accrued Expenses: Accrued expenses are expenses incurred but not yet paid for. Accrued expenses should be treated as a liability to you. You are a debtor to the company to whom you incurred the expenses to. Settling it would involve the outflow of economic resources which could have been used to produce future economic benefits. Examples of expenses which may be incurred are wages, salaries, interest, taxes, and utility charges. Accrued expenses are showed in the balance sheet as a current liability (short term liability)

- Accrued income: Accrued income is income earned, i.e. you have already produced and supplied the goods or rendered the services, but you have not yet been paid. It should be treated as an asset to you. An example of accrued income is interest receivable on bonds. The accounting entry to record the accrued income would be as follows:

Debit: Interest income receivable account; Credit: interest on bonds account. On the date of the receipt of the interest, Debit: Bank; Credit: interest income receivable

- Prepaid expenses: Prepaid Expenses are considered an asset to the business. They are simply expenses paid for now, which would be incurred at a later date. When treating it in the financial statement (Statement of financial position to be precise), we write it down as a current asset.

Treatment of unusual transactions in the income statement

1) Long term contracts: For contracts that extend beyond one accounting period, a percentage of completion method or the completed contract method is used. Percentage of completion method is used when the outcome of a long term contract can be reliably estimated. It is used under both the IFRS and US GAAP. It is derived at by taking the total cost incurred to date divided by the total expected cost; by using this percentage, costs, revenue and profits are recognized as work is performed.

IFRS Treatment of contracts whose outcome cannot be reliably measured under the IFRS, if the firm cannot reliably measure the outcome of the project, then revenue is recognized to the extent of contract costs; costs are expensed when incurred, and profit recognized only at completion.

US GAAP (treatment of contracts whose outcome cannot be reliably estimated.)Under the Us GAAP, when the outcome of the project cannot be reliably estimated, then we use the completed contract method. In the completed contract method, revenue, expenses and profit are recognized only when the contract is complete; in a situation whereby a loss is expected, the loss must be recognized immediately both under the IFRS AND US GAAP.

2) BARTER TRANSACTION

A barter transaction is when two parties exchange goods or services without cash payments. It involves the sale of goods to one party with the simultaneous purchase of almost identical goods from the same party.

Treatment under US GAAP Revenue from barter transactions under US GAAP can be recognized at fair value only if the firm has historically received cash payments for such goods and services and can use this historical experience to determine fair value. In a case where there has not been any historical experience, the revenue is recorded at the carrying value of the asset surrendered.

Treatment under IFRS Under IFRS, revenue from barter transactions must be based on the fair value of revenue from similar non barter transactions with unrelated parties.

3) Installment sales

They are sales financed by the firm making the sale. In installment sales, payment for the sale is not immediate, thus the financing part on the firm making the sale. The seller expects to receive payment for the sale over an expected period.

Treatment of installment sales Under the US GAAP, if collectability is certain, revenue is recognized at the time of sale using the normal revenue recognition criteria. If collectability cannot be reasonably estimated, we use the installment method. If however there is no hope of ascertaining collectability, then we use the cost recovery method.

Breaking down installment method and cost recovery method.

Installment method: Under the installment method, profit is recognized as cash is collected. The first step would be to calculate the total expected profit as a percentage of sales; then on receiving payments with each period, we multiply the cash received by (the total expected profit as a percentage of sales) to get the profit for the period.

Cost recovery method: Under the cost recovery method, profit is recognized only when cash collected exceeds costs incurred. Example:A piece of land was sold on installment basis for $2000. The original cost of the equipment is $1600. Collections received over a span of 3 years are:

| Year | 2010 | 2011 | 2012 |

| Collections | 800 | 800 | 400 |

Installment method:

Step 1: Calculate the total expected profit as a percentage of sales

Profit = Sale value – total cost

= 2000 -1600

= 400

Total expected profit as a percentage of sales = 400/ 2000 = 0.20

Step 2: Determine the corresponding profit for the year:

2010 = $800 X 0.20 = $160

2011 = $800 X 0.20 = $160

2012 = $400 X 0.20 = $80

Cost recovery method

For the cost recovery method, the collections received during the 2010 and 2011 are applied to the recovery of the cost. In 2012, profit of $400 is recognized.

Recommended Reading

Baruch Englard., Schaum’s Outline of Intermediate Accounting II

Leave a Reply