Dr. Pepper Snapple Group (DPS)

Case Abstract

Dr pepper Snapple group (DPS) is the leading producer of flavoured beverages in North America and the Caribbean, offering more than 50 brands. It is the third largest producer of carbonated drinks with an estimated market share of 5%. DPS trails behind only coca-cola and Pepsi co which have estimated market shares of 47% and 21% respectively. DPS specializes in Cola and flavoured soft drinks, with well known brands such as 7up, Canada dry, Schweppes and Clamato. DPS operates 24 production plants, with almost all beverage concentrates produced in a plant in St. Louis Missouri. The business model includes both the company- owned, direct-store delivery (DSD), and third party distribution.

Soft drink companies face an ever changing world market. The question DPS seeks to answer to guarantee their future include: how can DPS continue to grow at levels that will satisfy shareholders? To what extent should acquisition, joint ventures, licensing agreements, and or internal growth tactics be pursued? Should DPS diversify into other product markets such as snacks which Pepsi Co is using to create competitive advantage? What geographic growth options are best for DPS to pursue? Should any product or brands be divested?

Vision statement

To be the best beverage business in America.

Mission statement

Dr pepper Snapple Group’s vision statements are fused as follows: “At Dr Pepper Snapple Group, it is our vision to be the best beverage business in America.” DPS brands have been synonymous with refreshment, fun and flavour for generations, and their sales have the tendency to keep growing in the future. This statement is straightforward and informatively average. It establishes the company’s goal and core values. Also, it highlights DPS’s interest in future sales growth. The company includes its business strategy stating it focuses on building and enhancing leading brands, pursuing profitable channels, packages and categories, leveraging an integrated business model, strengthening routes to markets, and improving operating efficiency (Dr.Pepper Snapple Group)

External Audit:

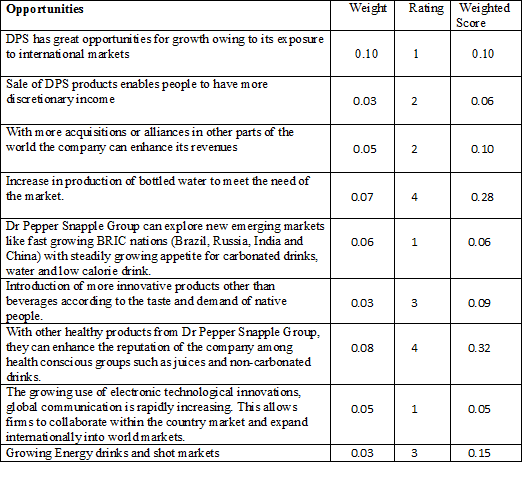

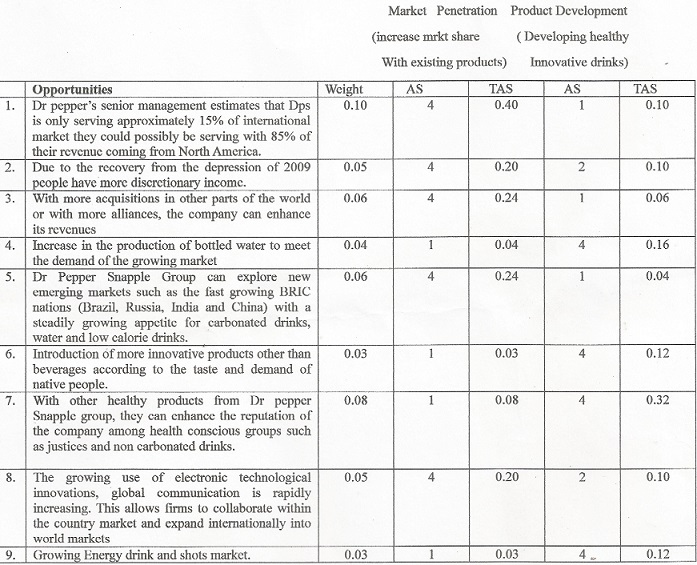

Opportunities

- DPS has great opportunities for growth owing to its exposure to international markets.

- Sale of DPS products enable people to have more discretionary income.

- With more acquisitions or alliances in other parts of the world the company can enhance its revenues.

- Increase in production of bottled water to meet the need of the market.

- Dr pepper Snapple Group can explore new emerging markets like fast growing BRIC nations (Brazil, Russia, India and China) with steadily growing appetite for carbonated drinks, water and low caloric drinks.

- Introduction of more innovative products other than beverages according to the taste and demand of native people.

- With healthy products from Dr Pepper Snapple group, they can enhance the reputation of the company among healthy conscious groups such as juices and non-carbonated drinks.

- The growing use of electronic technological innovations, global communication is rapidly increasing. This allows firms to collaborate within the country market and expand internationally into world markets.

- Growing Energy drinks and shot market.

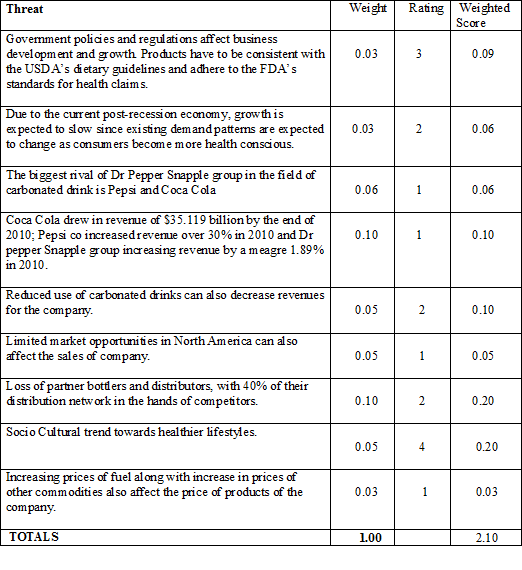

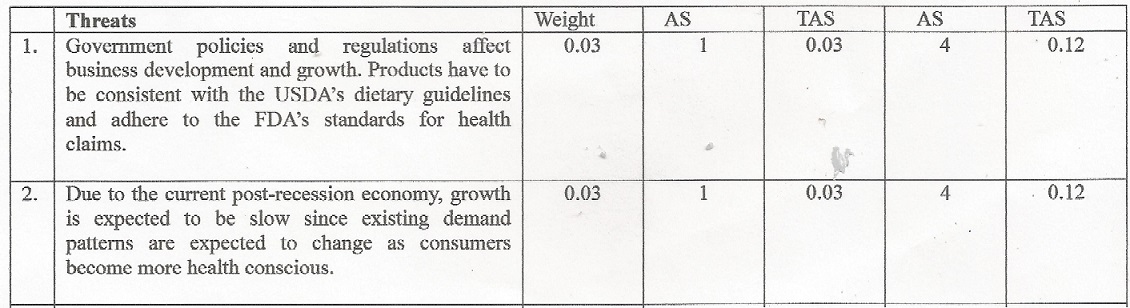

Threats

- Government policies and regulations affect business development and growth. Products have to be consistent with the USDA’s dietary guidelines and adhere to FDA’s standards for health claims.

- Due to the current post-recession economy, growth is expected to be slow since existing demand patterns are expected to change as consumers become more health conscious.

- The biggest rival of Dr pepper Snapple Group in the field of carbonated drink are Pepsi Co. and Coca Cola.

- Coca Cola drew in a revenue of $35.119 billion by the end of 2010, whilst Pepsi Co increased their revenue over 30% in 2010. During the period under review, Dr pepper Snapple group managed to increase revenue by a meager 1.89% in 2010.

- Reduced use of carbonated drinks may decrease the company’s revenues.

- Limited market opportunities in North America can also affect the sales of the company.

- Loss of partner bottlers and distributors, with 40% of their distribution network in the hands of competitors.

- The effect of Socio-cultural trend towards healthier lifestyles

- Increase in price of fuel along with increase in price of other commodities can also affect the pricing of Dr pepper’s products.

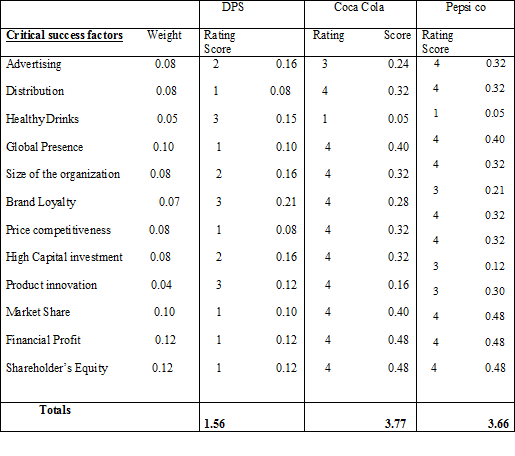

Competitive Profile Matrix

Dr pepper’s Score of 1.56 reveals a below average competitiveness when compared with Coca-Cola and Pepsi Co. This is partly due to a demerger of Cadbury Schweppes from Dr Pepper back in may 2008, and also its initial public offer in 2008/2009, a year of financial crisis in USA took a toll on shareholders’ equity.

EFE Matrix

Dr Pepper Snapple group received an above average rating of 2.10 from a possible 4.0. This can largely be attributed to its upcoming line of healthy drinks such as Dr Pepper ten (10) and also the availability of discretionary income by the populace after the depression.

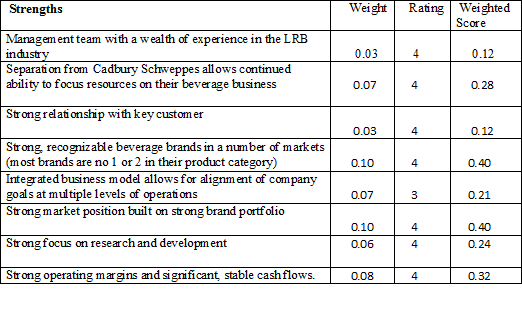

Internal Audit

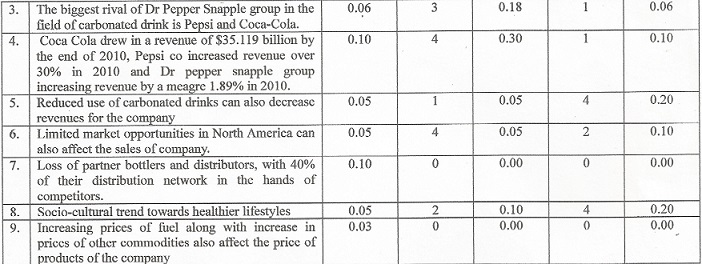

Strengths

1) Management team with wealth of experience in the LRB industry

2) Separation from Cadbury Schweppes allows continued ability to focus on their beverage business.

3) Strong relationship with key customers

4) Strong, recognizable brands in a number of markets (most brand are No 1 or No 2 in their product category)

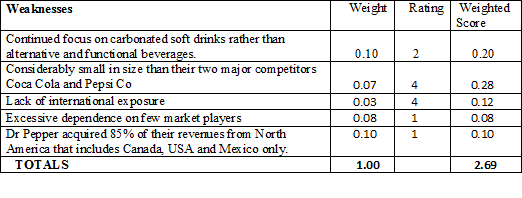

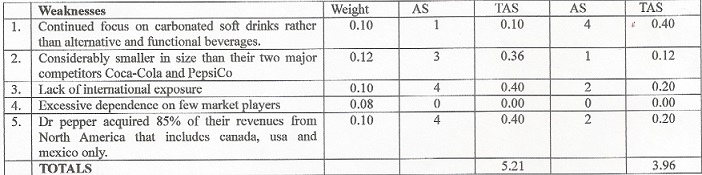

Weaknesses

1) Continued focus on carbonated soft drinks rather than alternative and functional beverages .

2) Considerably smaller in size when compared with their two major competitors Coca Cola and Pepsi Co.

3) Lack of international exposure

4) Excessive dependence on few market players

5) Dr pepper acquired 85% of their revenues from North America that includes Canada, USA and Mexico.

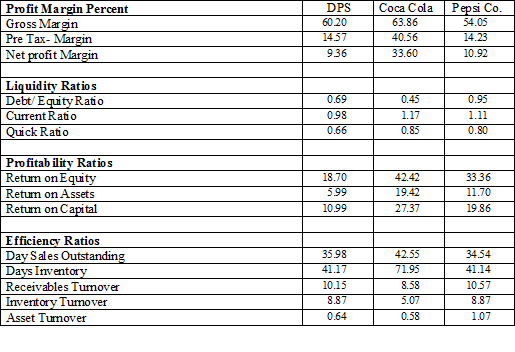

Financial Ratio Analysis (2010)

Dr Pepper Snapple Group is a healthy company but with very low profitability ratios. This may be due to the fact that the company was recently listed as a public company and is inexperienced in the capital market.

Porter’s 5 Forces Analysis

Suppliers ‘Power – High

Suppliers’ power on Dr pepper Snapple’s Input is high. Dr pepper Snapple Group’s inputs include commodities such as sugar, corn, PET, fuel, aluminum, apple juice concentrates. A a result, DPS has very little power as there can be price fluctuations in the commodity market; though it can be said that Dr pepper still has little control over the prices they ultimately end up paying, by entering into forward contracts for the delivery of resources, and so on.

Barrier to Entry- High

Barriers to entry into Dr pepper Snapple’s industry are relatively high since brand recognition is incredibly important. Additionally, larger firm experience significant benefits from economics of scope and scale, making it difficult for new entrants to match their operational efficiencies. Independent brands are able to find success in niche and local markets.

Buyers’ Power – Range from low to medium

Depending on their buyers, buyers’ power ranges from low to medium. The Coca Cola Company and Pepsi Co inc. cover roughly 40% of Dr Pepper Snapple Group’s beverages concentrates distribution segment and are considerably larger in size than DPS. However, these agreements are contractual, so few changes can be made. Beyond this, other buyers of Dr pepper’s beverage concentrates have lower buyer’s power.

Threat of Substitutes- Range from low to medium

There are arguably three major players in the beverage and soft drinks industry, they are Coca Cola, Pepsi co and Dr pepper. Competition is generally among these players and they most times produce substitute products that may be cannibals of their previously established products. The reason for this is the high degree of competition, you either evolve with innovative products to suit customer’s ever changing taste, or you go out of business. However, since integrated beverage producers experience large benefits from economics of scale, all major players in the industry offer a very wide range of beverage options.

Degree of Rivalry- High

With only three major players in the integrated beverage industry, the degree of rivalry is very high. Coca-Cola Company, Pepsi Co and Dr Pepper Snapple Group all offer products in every major non-alcoholic beverage category which directly competes with one another. They offer superior brands with pricing power that has developed loyal customers. Since brand loyalty plays such an important role in this industry, major players compete on brand image rather than price, making marketing and advertising a very important aspect of these three companies’ sales.

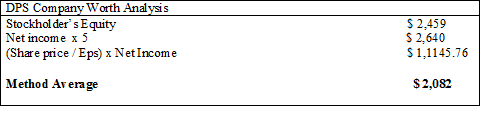

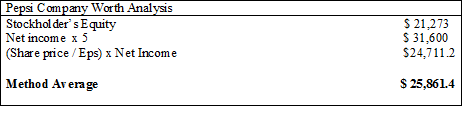

Net Worth

IFE Matrix

Tows Matrix

SO Strategies

1) Acquire distributors in other parts of the world for forward integration (S5,O3)

2) Increase advertising costs by $30 million to reach a global audience (S8, O1)

3) Build and enhance leading brand by investing in innovation, and developing these brands to match consumer preference (S3,S4,S6)

WO Strategies

1) Enter into the bottled water market (W1, O4)

2) Strengthen the distribution network in the BRIC nations, by signing exclusive agreements with local distributors.

3) Focus on opportunities in high growth and high margin categories, alternative beverages such as flavoured waters and energy drinks. These beverages tend to be healthier than traditional soft drinks and/or provide a functional benefit such as caffeine or taurine. (W1,O4,O6,O7)

ST strategies

1) Market to consumers more readily the healthier products of DPS (S3, S6, T1, and T8)

2) Use the management expertise at its disposal to optimize operational cost and keep prices at a competitive level (S1 T9)

WT Strategies

1) Aggressive Advertisement to compete with Coca Cola and Pepsi co on the international scene. (W5, T4, T6)

2) Creative and market variety of functional products like energy drinks, coffee. (W1, T2, T5)

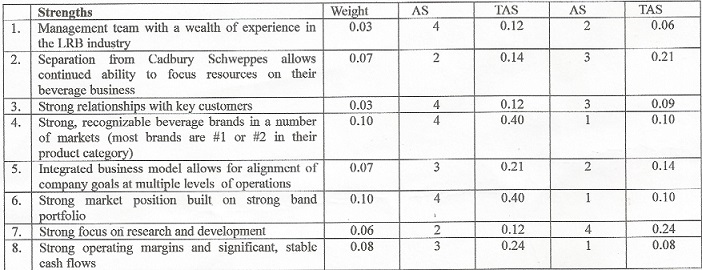

QSPM (Quantitative Strategic Plan Matrix)

RECOMMENDATION

1). Increase advertising budget by $30M over the next 2 years to invade international markets

2) initiate a forward integration process by acquiring distributors in local markets (at a cost of $66M)

3) Hire a market research firm to assess the feasibility of adding a new healthy line of drinks for a cot of $4m

Total Amount of Funds Needed = $100M

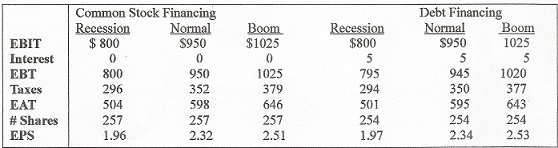

EPS / EBIT Analysis (In millions except for EPS and Share price)

Amount needed: $100M

Stock Price: $35

Shares outstanding: 254

Interest Rate: 5%

Tax Rate: 37%

From the above analysis, it would be better for DPS to finance the proposed recommendations through debt financing, because interests are tax deductible, and they increase the earnings per share for the equity holders.

EPILOGUE:

Dr Pepper’s net income is still very low compared to the income of its main competitors Coca Cola and Pepsi co. This is largely been due to their low market share in the international playing field, with most of their profit originating from North America. Dr pepper is initiating a strategy to tackle its distribution problems and make available its products in the international market by developing systems for third party bottlers and distributors to help them maintain priority for their brands in other companies’ systems. They are also focusing on opportunities in high growth and high margin categories. The most recent trend in liquid refreshment beverage (“LRB”) industry is the emergence of alternative beverages tend to be healthier than traditional soft drinks and/ or provide a functional benefit such as caffeine or taurine.

Recommended Readings

Marc Cosentino., Case In Point: Complete Case Interview Preparation, 8th Edition

Micheal Shearn., The Investment Checklist: The Art of In-Depth Research

Recommended Courses

University of Illinois at Urbana-Champaign; Corporate Strategy

University of Virginia; Business Growth Strategy

University of Virginia; Business Strategy in Practice (Project-centered Course)

Leave a Reply