Double Entry Accounting system

As an accounting graduate, I deemed it necessary to discuss the double entry accounting system, which is the building block for modern accounting and book keeping. Before we delve into the discussion of the double entry system, let us start with the accounting equation.

The accounting equation states that

A = L + C

Where:

A = Assets

L = Liabilities

C = Capital

What is an asset you may ask. Well an asset is an economic resource arising as a result of past events or activities, expected to generate future economic benefits to the owner or user of the asset. What then is a liability? A liability is simply an obligation to be settled, which would result in an outflow of resources.

The final piece of the puzzle, capital, also referred to as shareholder’s equity, is the resources provided by the owner of the business, to start the business or maintain it on a going concern basis.

From the above equation, we can say:

Since A = L + C

Then L = A – C

And also C = A – L

I.e Liabilities = Assets- Capital

And capital = Assets – Liabilities

It is possible to record transactions this way, for example, if capital of $5,000 is injected into the business by the owner, we go to our existing equation and add the newly injected $5,000 under our capital for the business. Let’s assume that a total liability is $150,000 and total capital is $45,000. This means the existing equation would have been:

Assets (A) = Total Liabilities + Capital

Where

Assets =?

Total liabilities = $150,000

Capital = $45,000

Asset (A) = $150,000 + $45,000

Asset (A) = $195,000

Total assets with us at the beginning would be $195,000. Now that the owner has injected an additional $5,000 capital into the business, we add it to the equation to derive our new total asset:

i.e A = L + C

A = $150,000 + ($45,000 + 5,000)

A = $150,000 + $50,000

A = $200,000

That means our new total asset is $200,000. This might look simple to do, but the record keeping of specific items such as cash and receivables might be cumbersome especially when there is a large volume of transactions. To make this easier, an account system was developed. What then is an account?

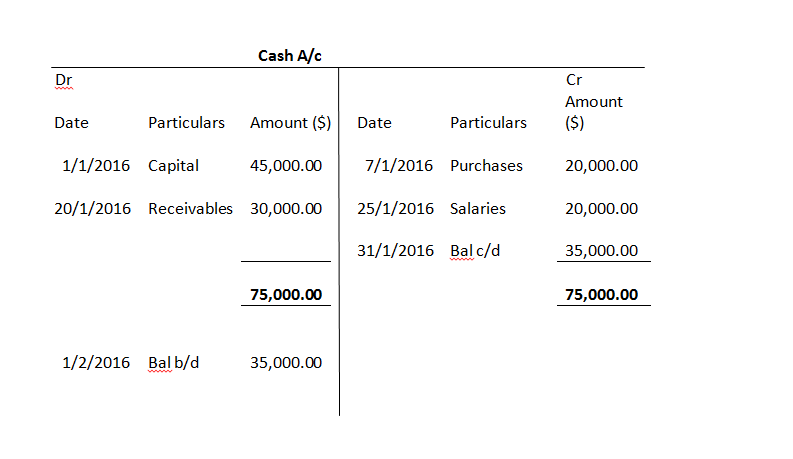

An account may be defined as a record of the increases, decreases and balances in an individual item of asset, liability, capital, income or expense. The T account is the most common form of account; it begins with the name of the account or account title, then we divide it into two equal parts, with the left being the debit side and the right the credit side.

The increases are entered on one side, while the decreases are entered on the other side. At the end of the period, we balance the account by taking the excess of one side over the other, and placing it as a b/c (balance carried down) at the side with the lower amount. When taking the account to another period, we bring that balance as balance brought down and place it on the side with the larger amount.

Debits and Credits

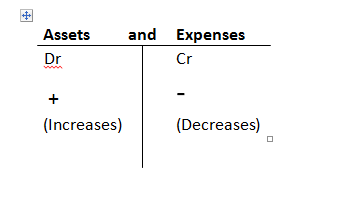

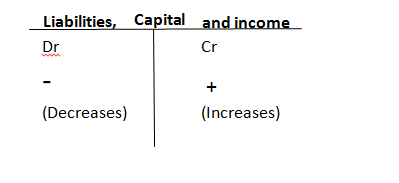

From the above example, the transactions on the left side are debits and the account is said to be debited, while the transactions on the right are credit transactions, and with the occurrence of each, the account is said to be credited. There are principles for how each category of items should be treated when debiting or crediting. Increases in assets and expenses are recorded as debits, whereas increases in liability, capital and income are recorded as credit.

We can represent this using the T account as follows.

Just a quick note, when I started out with accounting, my seniors told me to remember two basic principles when posting into accounts. These principles are:

- Debit the receiver

- Credit the giver

Let me explain further with some examples. Let’s use an asset and liability account, cash and creditors (trade payable) respectively. For cash, anytime we receive money into our cash account from other assets or liabilities, we debit it for receiving in cash. When it is to settle an obligation or liability, for example wages and salary, then we credit the cash account because it is the giver and there has been an outflow of resources. So in this case, we need to give credit to the cash account.

For creditors (trade payable), we are owing our business partners, that is why they are creditors to our business. Because they have availed us a resource or resources without us paying for it yet, that makes them the giver and we the receiver. We need to credit them for the resources they made available for our use without us paying yet. If we pay them later on for the said resource, then that makes them a receiver, because they are receiving payment for the resource; so we need to reduce our liability to them by debiting their account in our books.

Ledger

Ledgers are very essential in the preparation of financial statements. Ledger can be defined as the complete set of accounts for a business entity which can be used to summarize transactions and financial data. Ledger accounts can be classified into two which are:

- Personal accounts: These are ledger accounts that belong to third parties. Examples of personal accounts are the individual accounts maintained by the company on behalf of trade payables (Creditors) and receivables (debtors). For example if Mr wilson is a creditor to the company then the individual account maintained on his behalf is a personal account.

- Impersonal account: These are ledger accounts which are not for third parties. Impersonal ledger accounts can be subdivided into real and nominal ledger accounts.

- Real Ledger accounts: Real ledger accounts are ledger accounts of assets of the enterprise. For example cash account, motor van account, Plant & Machinery account Furniture & Fitting account and so on.

- Nominal accounts: Nominal accounts are accounts for income expenses and liabilities of the enterprise. Examples of Nominal accounts are rent account, purchases account, stationery account, salaries account and so on.

Double Entry

Yes! Finally, the topic for today. Sorry I had to digress so that you would have a better understanding of the double entry system. Hope I am forgiven? Cool! Let’s jump right in then. When recording transactions, each complete entry is recorded twice as debit entry and credit entry. These two entries taken together are referred to in accounting as double entry, and the approach of recording, in which a complete entry is recorded twice, is referred to as double entry system. Other methods of recording are the single entry system and incomplete recording system.

Advantages of double entry system:

- It provides a complete record of transaction from its debit and credit view

- It makes it easy to view account balances of the people the company deals with. It also makes it easy to trace individual transactions for check or audit purposes.

- It provides an arithmetical check on records since the total of the debit entries must equal the total of the credit entries, and consequently the total of the debit balances must equal the total of the credit balances.

- The balance of the nominal accounts can be collected together to prepare an income statement

- Balances of real ledger accounts can be collected together to prepare the statement of financial position which can be used to ascertain the financial position of the business at any given time.

Recommended Reading

Joel Lerner., Raul Gokam., Schaum’s outline of Book keeping and Accounting

Leave a Reply