To keep track of transactions, we need to continuously record entries into their respective ledger accounts. Depending on the size of the business, an organization may have millions of cash or bank entries as receiving from debtors and payment to creditors occur on a daily basis. To keep the ledger from getting too congested, a separate book dedicated to recording cash and bank entries are usually maintained. This dedicated book is known as the cash book.

What is a cash book?

A cash book is a financial journal in which cash receipts and payments including bank deposits and withdrawals are recorded first in a chronological order (ie recorded according to the date of transaction). There are two types of cashbooks, and they are the 2-column cash book and the 3-column cashbook. Before going into details of the types of cash book, let’s first look at a peculiar transaction that occurs in the cash book. This transaction is the contra entry transaction.

Contra Entries

A contra entry is an entry that appears on both sides of a cash book when cash is deposited into the bank account of the cash at hand of the company, or when cash is withdrawn from the bank account for office use.

2 column cash book

As the name implies, this type of cash book has two columns; one for recording bank and the other for recording cash transactions. The two columns on the left hand side of the cash book are for recording cash or bank receipts under their respective headings (cash or bank), while the two columns on the right hand side of the cash book are for recording cash payments or payments by cheque under their respective headings. To reiterate, the left hand side of the cashbook is for recording receipts, while the right hand side is for recording payments.

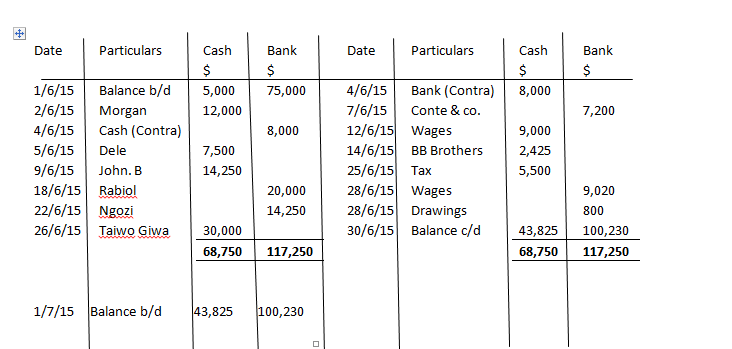

Example of a two column cash book:

Question:

On the 1st of june 2015, Victor, a trader had $5,000 as cash in hand and a balance of $75,000 in his bank account. The following are transactions of Mr victor for the month of June 2015.

June 2nd : Received the sum of $12,000 from Morgan

June 4th : Deposited $8,000 into the bank

June 5th: Sum of $7,500 received from Dele

June 7th: Settled the account of Conte & co. $10,000 by cheque after deducting 8% discount.

June 9th: John B settled his account of $15,000 less 5% discount

June 12th: Paid wages of $9,000 by cash

June 14th: Paid BB Brothers account of $2,500 less 3% discount

June 18th: Received a cheque of $20,000 from rabiol after allowing a discount of $1,000. The cheque was deposited into the bank immediately.

June 22nd: Ngozi’s account of $15,000 was settled by cheque after deducting 5% discount.

June 25th: Paid tax office the sum of $5,500 by cash

June 26th: Received from Taiwo Giwa the sum of $30,000 after allowing a cash discount of $1,500

June 28th: Paid wages by cheque $9,020 and withdrew $800 by cheque for private use.

You are required to prepare a 2 column cash book for victor for the month of June 2015.

Possible solution:

3 column cash book

A three column cash book has an extra column for each side in addition to the two columns for bank and cash. This third column is used for recording the cash discounts allowed to debtors and the cash discounts received from creditors.

What is a cash discount?

A cash discount is the amount allowed off (i.e deducted from) debts to encourage settlement of the debt within a specified period of time. Cash discounts may also be used as a competitive strategy to steal customers away from competitors, with the sole purpose of increasing sales and market share.

Discounts allowed are cash discounts a business gives to its debtors when they settle their obligations while discounts received are cash discounts a business receives from its suppliers or creditors when making payments. The discount column on the left-hand side of the cash book is for discount allowed to debtors, while the discount column on the right hand side of the cash book is for discount received from suppliers or creditors.

An example of discount allowed is when a customer is allowed cash discounts. The accounting treatment of this would be to debit the cash book’s discount allowed column while crediting the customer’s personal account. When the business receives discount from creditors or suppliers, the accounting treatment would be to credit the cash book’s discount received column while debiting the creditor’s personal account.

At the end of the period, the total of the discount allowed column is transferred to the debit side of the discount allowed account in the general ledger while the total of the discount received column is transferred to the credit side of the discount received account in the general ledger.

Note that the discount columns in the cash book act as a memoranda, meaning that it is not part of the double entry system. They are merely used as convenient means of accumulating the discounts before the totals are posted to the discount accounts in the general ledger.

Example of a 3 column cash book

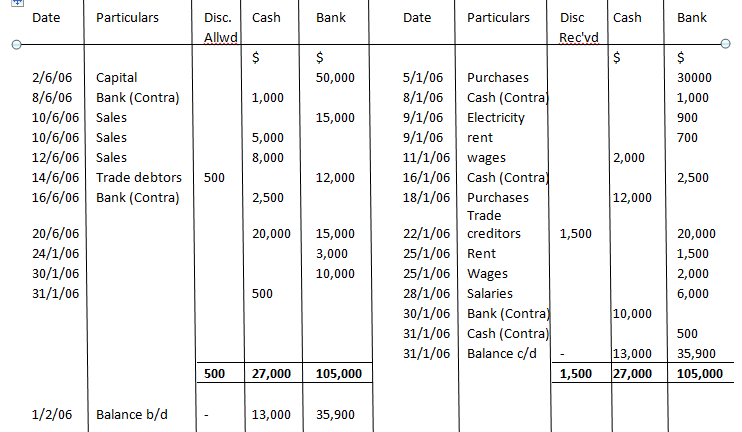

Question: Lolade started a business with $50,000 on 2/1/2006 which he paid into a bank account for the business on the same date.

Transactions for the first month of business (January, 2006) are thus:

Jan 5th: Purchases by cheque $30,000

Jan 6th: Credit purchases $17,000

Jan 8th: Drew cash for office use $1,000

Jan 9th: Electricity paid by cheque: $900; rent: $700

Jan 10th: Made sales by cheque of $15,000 while also making sales by cash of $5,000 and sales on credit of $18,000

Jan 11th: Paid wages of $2,000

Jan 12th: Cash sales of $8,000

Jan 14th: Received from customers cheque of $12,000 and allowed discount of $500

Jan 16th: Drew cash from the bank for office use: $2,500

Jan 18th: Purchases:

By cash: $12,000

By cheque: $4,000

On credit: $25,000

Jan 20th: Sales by cash of $20,000 and sales by cheque of $15,000

Jan 22nd: Paid creditors $20,000 by cheque and received discount of $1,500

Jan 24th: Cash sales of $3,000 which was immediately lodged into the bank

Jan 25th: Payments by cheque for rent: $1,500 and wages: $2,000

Jan 28th : Salaries by cheque $6,000

Jan 30th: Cash lodged into bank: $10,000

Jan 31st: Drew cheque for petty cash: $500

Possible solution:

Recommended Reading

Joel Lerner., Raul Gokam., Schaum’s outline of Book keeping and Accounting

my concern is about the method of treating your DREW CHEAQUE FOR PETTY CASH. to my own suggestion, since the petty cash and main cashbook are different I think the corresponding entry for that should not be debited to the cashbook but to the petty cashbook as receipt. eg drew cheaque for electricity payment. the entry will be debit electricity a/c and credit bank a/c under the cashbook.thks

Hello Olawumi, thank you very much for your comment. The “drew cheque for petty cash” transaction represents the first leg of the transaction. When the cash drawn is then injected into the petty cash account, we credit our cash account and debit our petty cash account. From the example, you can see that it was a contra entry, with a credit to our bank for giving out the cash and a debit to our cash account for receiving the cash. After this, the owner possibly releases the cash from the cash book to the petty cash account and the transaction i discussed earlier takes place. Kindly note that apart from the money injected into the petty cash account, no receipt however small it may be is recorded in the petty cash book as only petty expenses are recorded in the petty cash book.

a good explanation,my quiry is how do we treat the transaction of all casg deposited into the bank except certain amount,help out please.

it’s cash not casg

Hi Okode, with respect to your question, if cash from the business is deposited into the bank, this represents a contra entry in the cash book. The accounting entry is to debit the bank account on the debit side of the cash book (for the bank receiving the cash) , and then the corresponding entry would be to credit the cash account on the credit side of the cash book (For the cash account giving the bank cash). Also, can you please provide further explanation on what you mean by except certain amount? In the time being, i hope this answers your question. Cheers.