How to write a Business plan

Assuming the three basic career things I love to do in life are: firstly, to start my career in tax consulting in order to learn the fundamental process of providing tax regulatory service (as tax appears to be one of the most profitable, if not the most profitable aspect of professional accounting service). Secondly, to get a job as a research analyst or portfolio manager in an asset management firm (maybe with an MBA and after 2 years in tax job). Thirdly, and finally, to learn programming, from the basic html to C, C++, Java, Php, etc. The goal is just to do this last one on part time basis and develop applications for myself or my clients using the acquired knowledge.

Okay, let’s recapitulate. The plan is to set up my own tax regulatory service firm in my late thirties after working in a tax consulting firm and asset management firm, and after developing my programming skills. This doesn’t seem like a bad idea, is it? What do you think?…lol… I am just 21 years old now, but that doesn’t mean I have to wait till I am 35 before learning to write business plan and acquiring the knowledge I need for my proposed business’ success.

So, with this at the back of my mind, I carried out a research on the key areas of business plan writing, and I am here to share my discovery with you. Note, this article on business plan served as a very useful guide in writing this post and in my research process. I 100 percent recommend it. Maybe I would later draw up a format for the tax regulatory service discussed above.

Now back to the business plan. The first step is to write an Executive Summary in order to plan the general way and manner of approach to the business plan writing. Let’s look at the writing of executive summary in detail.

Executive summary

An executive summary is the overall outline of a business plan. Executive summary is a very important section of the business plan because it is the section the reader first comes across. If one does not write an attractive and compelling executive summary, one’s reader might lose interest in one’s business and not spare time to read the other sections of one’s business plan. It is therefore advisable that one writes the executive summary last because some of the information which goes into the executive summary may not be ready until a later stage of the business plan writing. For an already established business, the executive summary should include a mission statement, company description, Market analysis and marketing plan, product description, growth highlights, financial projections and financial summary. It is noteworthy that topics like company information, market analysis, product description etc. in the executive summary basically make up the business plan. Each of them needs to be briefly summarized in the executive summary, and then elaborated later in their individual sections.

Mission statement

A mission statement seeks to define the fundamental and unique purpose of a business, with the aim of distinguishing it from other businesses which provide similar services. A mission statement should state the scope of the company’s operations in terms of products or services offered, and also state the market to be served. In my case, when setting up a niche tax consulting services firm in tax due diligence (let’s assume that the name of my proposed business is mirage consulting), I may present my mission statement as follows:

“Mirage Consulting’s mission is to provide national and multi-jurisdictional tax due diligence that would avail her clients detailed understanding of historical and current tax risks and tax exposures on deals and how the risks and exposures can be mitigated. We would do so by providing detailed reports and analysis of tax implications on transactions, as well as analysis of historical tax control decisions taken by the relevant tax authorities. The company would work with a team of chartered accountants and CFA charter holders who are experts in providing industry focused and specialized support in wide range of transactions like mergers and acquisition, due diligence, vendor due diligence, bid support and general tax health checks.”

Company description

Here, one should briefly introduce one’s business to the reader. One can include information such as date of incorporation, founding members, the number of employees working for one’s business, management team, physical location or address of one’s business, website and other relevant information which can help potential investors locate one’s business.

In the real section (Company description) information on the history of the company may be provided if it is an already existing/established business, and the milestones reached by the company.

Market analysis

It is essential to carry out a market research before venturing into a business.Things to analyze include the industry description and outlook, the market for the business, market trends, customer analysis and competitive analysis.

- Industry description and outlook: In writing this, please, take a look at the industry you are seeking entry into, the players in the industry, current size of the industry, profitability and growth rates, using the industry average, product life cycle and other characteristics of the industry

- Market: Highlight your target market and the specific group of people you would be targeting. Explain your rationale for targeting that specific group.

- Market trends: Watch out for market trends that may fuel an increase in clients for your business and the services that would benefit you from these market trends. You can then go ahead to structure your service offerings based on these market trends.

- Customer analysis: Critically examine your possible customers and the services they may need, in order to market the right service to the right customer.

- Competitive analysis: Identify competitors based on product line or service and market segment. Analytical techniques commonly used in competitive intelligence are SWOT (Strength, weakness, opportunity and threat) analysis, Porter’s five force model, Porter’s four-corner exercise,ratio analysis, and strategic group analysis (also called competitive cluster analysis). These techniques can be used to assess the following:

- Strength and weaknesses (SWOT)

- Profitability in the industry (ratio analysis)

- Market share (Porter’s five force model)

- Barriers to entry (Porter’s five force model)

- Competitors response profile (Porter’s four corner exercise)

Management and organizational structure

People naturally want to know who is in charge, their competence and if such people can be trusted with the business they wish to invest in. It is advisable to include details about the ownership of your company, management team, their experience and qualifications, their area of responsibility, and their historical and future contributions to the company.

Organizational structure determines how activities such as task allocation, coordination and supervision are directed towards the achievement of organizational goals. You should specify each position, tasks or duties to be carried out by them, and the people they report to.

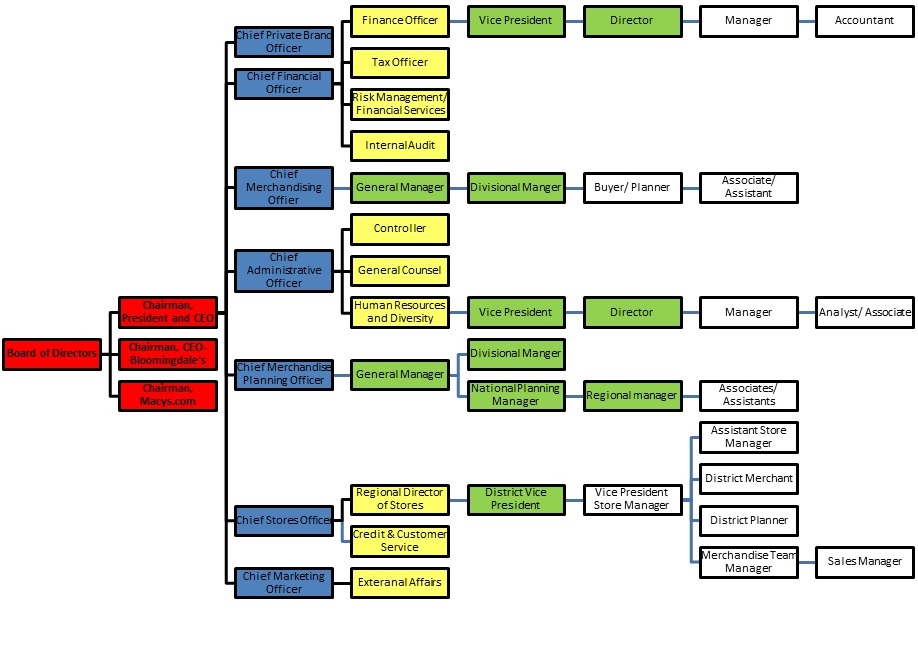

Diagram of an organizational structure:

Product Description

This should be a brief description of the products and services offered. An example of service description in Mirage Consulting is:

- Analysis of client firm’s profitability and cash flow and forecast of the firm’s future operational prospects.

- Analysis of the tax implications on deal structures such as mergers and acquisitions

- Structuring of acquisition transactions

- Analysis of financing options for acquisitions

- Structuring of newly acquired targets in order to minimize tax liabilities

- Tax health checks on existing or target structures.

You can go into more detail in the product description section of the business plan. Explain what these services are, and the value clients stand to gain by using these services.

Marketing Plan

A marketing plan should be created after your market analysis and your products are defined. You should give details of your marketing strategy and how you can capture some market share from your competitors. Marketing strategies include:

- Market Penetration strategy: It involves marketing the same product within the same market the company has been using by giving incentives to existing and potential customers to choose their products over those of the competitors. Check out Pepsi co’s market penetration strategy in Nigeria

- Growth strategy:This strategy is pursued by already established businesses seeking to expand their operations. A firm can grow internally by expanding its operations both globally and domestically, or it can grow externally through mergers, acquisitions, and strategic alliances.

- Communication strategy: To plan this, you need to know how you would get your products out there, that is to the knowledge of potential customers. You should determine if an advertisement campaign would be the best option, personal selling, showroom selling, promotion, affiliate networking and more.

Growth Highlights

For an existing business, it is advisable to include your growth highlights in the executive summary in order to give potential investors an idea of the benefits they stand to gain by investing in your business. An example could be an increase in market share, increase in sales revenue, increase in net income or increase in profit margins on a y/y basis.

Startup expenses & Capitalization

This should be included in the business plan of startup companies. You need to estimate expenses that are likely to be incurred to hit the ground running, and then plan how you will get the needed capital. A succinct description should be given in the executive summary, and then you can go into more details in the individual section. For a new business or startup seeking finance, you should include the cost of startup and how the capital derived would be utilized, projections of revenue, when you think the business would break even, financial risks faced and how they can be mitigated.

You should carry out detailed research for the business you want to enter into. Find out from already existing businesses what cost projections are. You should also have a contingency amount saved somewhere in case actual costs exceed projected costs.

An example for my proposed business (Mirage Consulting) which is a startup:

“To launch this business, we estimate that we would require approximately ₦10 Million of new capital. The fund obtained would be used for initial salary of employees, Professional training, office rent, office equipment and subscription to financial data vendors to help in the due diligence process. Based on our current projection and market analysis, we expect to generate between ₦4million and ₦6million in revenue from the second year. We estimate that our average total cost (including taxes) would be between ₦1.8million and ₦2.5million, thereby leaving us with an average net income after tax of between ₦1.5million and ₦4.2 million. The greatest financial risk we anticipate is not being able to generate enough clients’ demand for the services we offer. In order to mitigate this risk, we propose intensifying our marketing efforts and employing business development officers in addition to the core employees. Also, we are in the process of establishing an online tax academy with tutorials and tips for being more tax efficient. The purpose of this tax academy is to build our goodwill in tax regulatory services, and gain clients’ loyalty.”

Financial Summary and projections

Financial summary shows information about your current investors, capital structure or source of funding and any other financial information pertinent for potential and current investors to know. If you own an already established business, you would be expected to provide historical financial data related to your company’s financial data. This is a very important sections especially if you are seeking funding from creditors or investors. You can provide a 5-year financial summary, depending on the time you started the business. If it is less than 5 years, you can provide from inception to date.

Financial summaries should be on the income statement, balance sheet, statement of cash flows, for each year you have been in business.

Financial projections:

Whether you are an existing business or a startup, you would be required by creditors or investors to produce a financial projection, normally a five year projection. They would want to see your plans for the company and what you expect to achieve with the company in the next couple of years.

Appendix

Appendix should be written as the need arises. You can include details or information of essential documents that would clarify your plan, or make your plan visible to your audience. For example, you can list details of attachments outside the business plan that would add value for the reader. For instance, you can include details of spreadsheets used in your ratio analysis, 12 month profit and loss, break even analysis and more.

From the above, a business plan should follow this order

Executive Summary ———->Company description————–>Market analysis————–>Management and Organizational structure—————->Product description————>Marketing plan————–>Growth highlights————->Startup expenses and capitalization (for startups) ——–>Financial summary and projection————>Appendix

Still finding it hard to write that killer business plan? Why not check out our free business plan template in Msword or Pdf for your convenience: Business_plan_template.docx or Business_plan_template.pdf. For a more comprehensive sample of business plans with real life examples, why not check this link out: Business Plan Samples

So guys, hope you have learnt well today, this submission is not to be assumed as perfect, just got it from my research. If you have a better idea or format, please feel free to share in the comment section below. Bye for now guys…muah!!..

Recommended Readings

Rhonda Abrams., Successful Business Plan: Secrets & Strategies

Hal Shelton.,The Secrets to Writing a Successful Business Plan

Steven D. Peterson.,Business Plans Kit For Dummies

Leave a Reply