Problems caused by records in the bank statement

These include:

1) Correct entries in the bank statement only: They are referred to as standing orders. They are receipts or payments that are added or deducted at source without the prior knowledge of the account holder; except through his statement. Examples of receipts that may be found in the bank statement and not in the cash book include: Direct deposits by customers, interest or dividends for the business sent directly to the bank.

Examples of payments that may be found in the bank statement and not in the cash book include: standing order payments, bank charges and dishonoured cheques.

2) Incorrect entries in the bank statement only: These are mistakes made at the banker’s end. It may involve the recording of wrong entries as payments or receipts, or as both. If either or both of these mistakes are made, then the closing balance would be affected.

3) Difference in opening balance: When comparing the opening balance of the bank statement with the cash book, they may not be same as a result of transactions included in the previous month in the cash book and then included this month in the bank statement and vice versa. If this happens, then the closing balance of the bank statement would certainly differ from the closing balance of the cash book.

Preparation of a bank reconciliation statement

The first step in a bank reconciliation statement is to prepare an adjusted cash book. This is to take cognizance of either charges or receipts that may have occurred directly in the bank account without the knowledge of the business. Some of the transactions that may occur and their treatment in the cash book include:

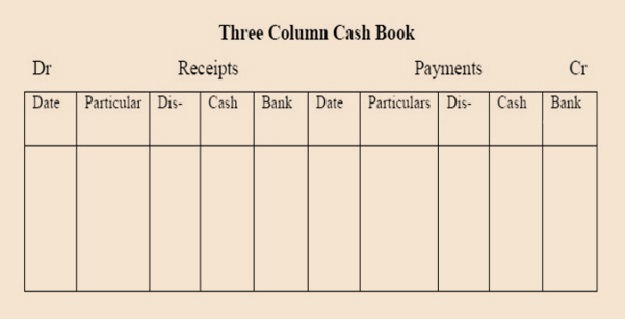

Example of a cash book

- Dividend or interest sent directly to the bank account

- Debit bank account column in the cash book

- Credit customer account

- Amount paid directly into the bank by customers

- Debit bank account column in the cash book

- Credit receivables account

- Standing order payment

- Debit standing order item account

- Credit bank account column in the cash book

- Bank charges

- Debit bank charges account

- Credit bank account column in the cash book

- Dishonoured cheques

- Debit customer or receivables account

- Credit bank account column in the cash book

After doing this, we check for errors made in recording the cash book and then correct them using the double entry principle. After these corrections, we get our adjusted cash book, and now we can begin with the reconciliation proper.

Format for bank reconciliation statement

Before I share the format of a bank reconciliation statement, please note that if on preparing your adjusted cash book the balance on the adjusted cash book agrees with the balance as per the bank statement, then there is no need to prepare a reconciliation statement. If on the other hand the balances still differ, then we prepare a statement known as the bank reconciliation statement.

Now let us look at the format for a bank reconciliation statement. We would be looking at the bank reconciliation statement by starting it with the balance as per adjusted cash book and also starting it with the balance as per bank statement. Let us begin with the bank reconciliation statement as per adjusted cash book.

XYZ ltd

Bank reconciliation statement as at ………………………….

| Balance as per adjusted cash book | XXXX | |

| Add the following | ||

| Unpresented cheques | XXX | |

| Wrong payment in the bank statement | XXX | |

| Previous period deposits credited in the bank statement this period | XXX | |

| Difference in opening balance if higher in the bank statement than cash book | XXX | |

| Any other payment in the cash book only | XXX | |

| XXXX | ||

| Deduct the following | ||

| Uncredited cheques | (XX) | |

| Wrong payment in the bank statement | (XX) | |

| Previous period cheques reflected this month in the bank statement | (XX) | |

| Difference in opening balance if higher in cash book than bank statement | (XX) | |

| Receipt in the cash book only | (XX) | (XXX) |

| Balance as per bank statement | XX |

XYZ ltd

Bank reconciliation statement as at ………………………….

| Balance as per bank statement | XXXX | |

| Add the following | ||

| Uncredited cheques | XXX | |

| Wrong payment in the bank statement | XXX | |

| Previous period cheques reflected this month in the bank statement | XXX | |

| Difference in opening balance if higher in cash book than bank statement | XXX | |

| XXXX | ||

| Deduct the following | ||

| Unpresented cheques | (XX) | |

| Wrong receipt in the bank statement | (XX) | |

| Previous period deposits credited in the bank statement this period | (XX) | |

| Difference in opening balance if higher in the bank statement than cash book | (XX) | |

| Any other payment in the cash book only | (XX) | (XXX) |

| Balance as per adjusted cash book | XX |

So guys, I hope with this explanation it would be easy for you to draft a bank reconciliation statement.

Recommended Reading

Joel Lerner., James Cashin., Schaum’s Outline of Principles of Accounting I

I really enjoy the lesson