Balance sheet

Today we would be looking at the balance sheet, also called the statement of financial position. The balance sheet is one of the required statements a company must file at the end of an accounting period, alongside two other statements which are the income statement and the Statement of cashflows.

A balance sheet is basically a statement of assets and claim over assets of an entity as at a particular date. It should be noted that the double entry principle is not followed since a balance sheet as its name implies is just the gathering together of balances which are then presented in a special way.

Since the assets and liabilities of a company are continually changing, the balance sheet is only valid as at the period stated. This means that a balance sheet as at 31st December 2015 may not be valid on the 31st of December 2016; especially if the business acquires more assets or incurs more liability within this period. The main purpose of the statement is to show a picture of the value of all assets of a company, and the values of the various claims on these assets at that moment. This helps in financial ratio analysis as current and potential investors can assess the liquidity risk, solvency or stability of the business, financial risk, credit risk and so much more from the figures on a company’s balance sheet.

Items used to prepare a Balance sheet

A balance sheet states the balances of ledger accounts, and it categorizes them into the following:

1) Assets: These are economic resources arising as a result of past events or activities, expected to generate future economic benefits to the owner or user of the asset. In simple terms, we call assets the properties of the business.

2) Liabilities: This represents outsiders claims over the assets. We can also define a liability has an obligation to be settled, which would result in an outflow of resources. According to the accounting equation, the value of the assets of an entity would always belong to either the owners of the business or its creditors. Accounting equation can be represented with the formula:

A= L +C

Where:

A = Assets

L = Liabilities

C = Capital

This means that the value of the asset of an entity can never at any point in time be higher or lower than the value of the claims of its owners and its creditors. It is important to know that a balance sheet must always balance.

Why, you ask? Well there are two reasons, which are:

a) Assets must equal the claim over assets

b) Entries that make up the balance sheet follow the double entry principles which requires that each item debited must have a corresponding credit entry.

Items in a balance sheet

As stated earlier, items in a balance sheet are categorized into Assets, Liabilities and Capital, i.e assets and claim over assets. In the balance sheet we arrange the assets in their order of liquidity; starting from the most liquid to the least liquid. Now that we have established the arrangement order, let’s delve into how items under assets, liabilities and capital are arranged.

Assets: In the balance sheet, assets are classified into:

a) Current assets

b) Non-current assets:

a) Current Assets: Current assets are cash and all other properties that are to some extent liquid and expected to be turned into cash or used up within a period of one year (12 months). Examples of current assets are: cash, accounts receivable, Inventory (stock), notes receivable, prepaid expenses etc. Note that items under the current assets are listed based on their order of liquidity; i.e from most liquid to least liquid (in some part of the world, it is the opposite, with the liquid coming first and the most liquid coming last).

b) Non- current assets: These are assets that are expected to be used up for a long period of time. So theoretically, they are expected to be used for a period longer than one financial year.

Non current assets can be further broken down to Non-current tangible assets (Fixed assets), Investments and Non-current intangible assets. Non-current tangible assets (Fixed assets) are physical properties of the business that are subject to depreciation and everyday “wear” and “tear”. They include plant and equipment, land and buildings, motor vehicles, furniture and fittings etc. Their main purpose is to aid the production of goods and services.

Investments on the other hand are properties of the business in the form of securities; for example shares, bonds, etc.; existing in another organization for a period greater than one year. Non-current intangible assets (deferred assets) are intangible and fictitious assets of the business such as Goodwill.

Liabilities: Also called outsiders claims over assets. They can be broken down into current liabilities and long term liabilities. Current liabilities are debts that must be satisfied from current assets within the next operating period usually a year. The difference between current assets and current liabilities gives us net working capital which is used to measure the short term liquidity of a business and critic how efficiently management is utilizing assets.

Long term liabilities on the other hand are debts payable beyond the period of one year. Long term liabilities are also called creditors due after one year. They include: bonds payable, loans, mortgage payable etc.

Capital: As we mentioned earlier, capital represents the claims of the owner of the business on total assets. This means it is the most permanent claim i.e the claim that would be settled last in case the business discontinues and is being liquidated.

Methods of preparing the Balance sheet:

They are basically two methods of preparing the balance sheet. They are:

- Horizontal method

- Vertical method

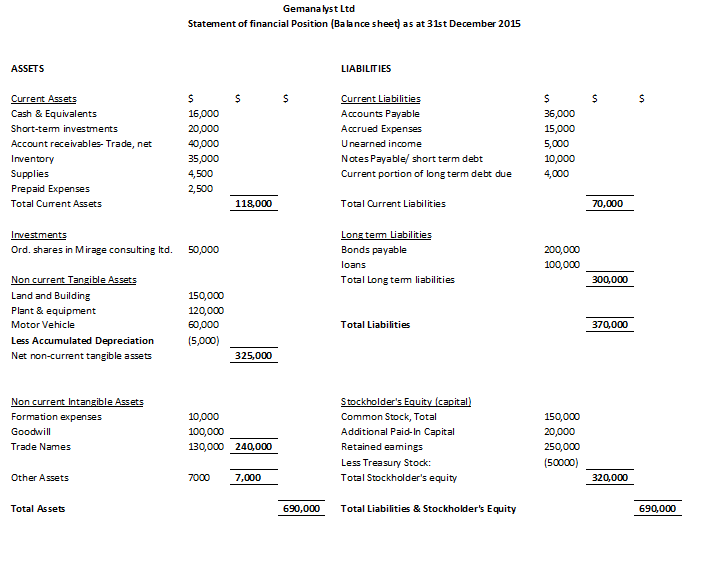

Horizontal method: Under this method, the balance sheet is prepared in a tabular format with the left side being the asset side and the right side being the liability side. The asset side is arranged starting from current assets to investments, non current tangible assets, and then finally progressing to non-current intangible assets.

The liability side or claims over assets is arranged as current liabilities (Creditors fallen due within one year), Long term liabilities (creditors fallen due after one year), and owner’s claim (capital or stockholder’s equity).

Example of the Horizontal format of the balance sheet:

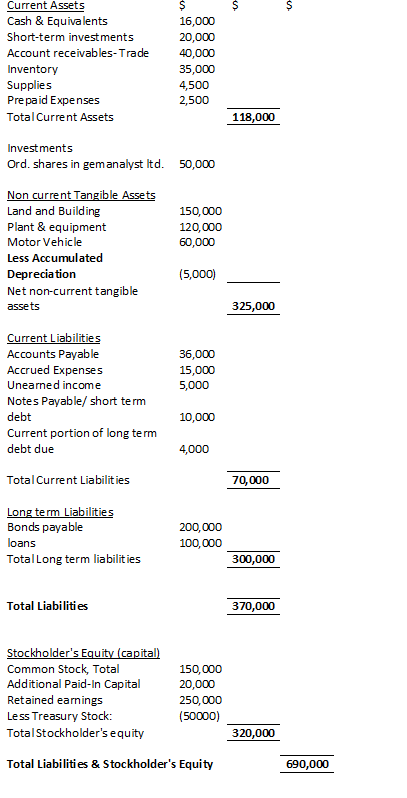

Vertical format: Under this method, assets are presented first, then the claim over assets follows. Arrangement under each item (current assets, non current assets etc) is similar to the horizontal format, but unlike the horizontal format that displays the balance sheet in a tabular form, the vertical format starts off with the current assets and every other thing falls below it.

Example of a balance sheet in the capital format

Recommended Reading

Joel Lerner., Raul Gokam., Schaum’s Outline of Principles of Accounting 1, Fifth Edition.

Leave a Reply